4 Advantages Of Life Insurance A Policy Surrender With Life Insurance Takes Years To Recoup The Value.

4 Advantages Of Life Insurance. Life Insurance (or Life Assurance, Especially In The Commonwealth Of Nations) Is A Contract Between An Insurance Policy Holder And An Insurer Or Assurer.

SELAMAT MEMBACA!

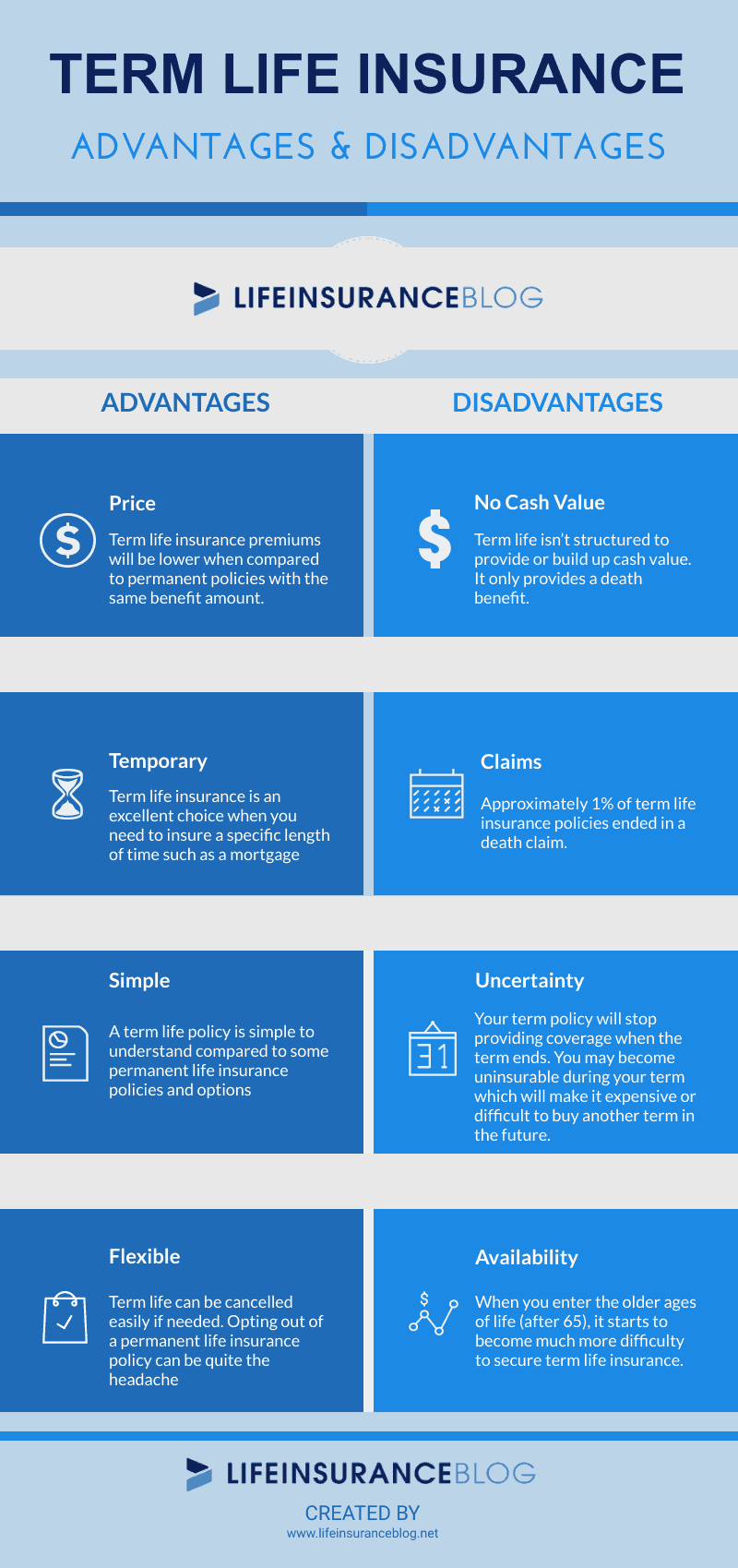

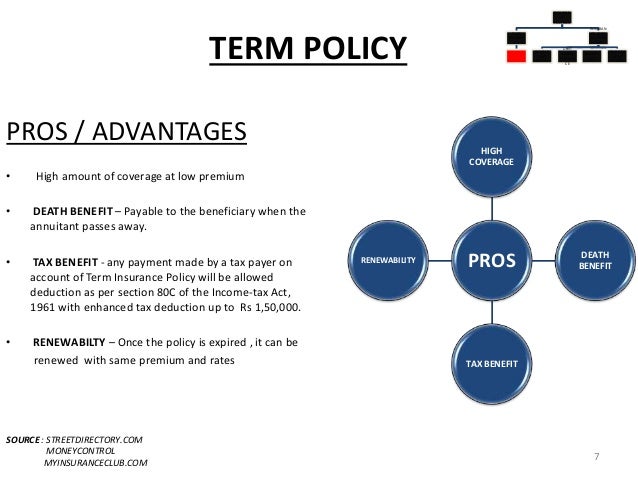

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

There are several advantages and disadvantages of life insurance.

Read on to know the benefits and drawbacks.

4 advantages of life insurance.

10/01/2015 07:31 pm et updated oct 01, 2016.

Whether it is a nonliving product like a car or it about our own health, we don't want.

What are the advantages and disadvantages of term life insurance?

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

· one of the most obvious advantage of life insurance that everyone seeks for is the financial protection for your family and loved ones.

In exchange of a relatively small amount of premium every month, you get a higher life cover that acts as a favourable financial cushion for your family and loved.

Term life insurance policies are still a great option with many advantages.

Life insurance have both advantages and disadvantages.

Buying the life insurance is one of the best decisions that everyone should make in their life.

Once you buy a life insurance for you this will be the decision on which you will never regret in your whole life but only a few people know the.

Life insurance is totally beneficial and serves as a financial support in those cases where the income of the family is stopped.

It helps by providing a what are the advantages of life insurance policy?

Life insurance as the name itself suggests is something that insures your life with a financial support.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

Life insurance pays a benefit when you might need it the most.

A policy surrender with life insurance takes years to recoup the value.

One of the advantages of whole life insurance is that you have a cash surrender value available.

Taking a whole life insurance policy leads to a number of benefits and advantages.

Advantages of term life insurance.

Initially less expensive premiums than whole life insurance, which can be great if you're trying to save money right now.

One of the biggest advantages of investing in life insurance is that you don't pay taxes on the money until you take it out.

If you keep paying premiums, you can keep the money in the account, accruing interest, until you die.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

![Term Life Insurance: Insider Tips [Research + Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/insproviders-live/9496f87a-term_life_insurance_advantages_disadvantages.png)

With various types of life insurance plans available, you can plan your.

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Advantages of life insurance 2.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

This life protection won't vanish if premiums are paid — it's a financial product that remains in place for your entire life.

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

Hdfc life insurance company limited.

If you have someone in your life.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or key man life insurance is highly recommended to help the company survive the hardship of losing a key employee.

The life insurance proceeds will be used by.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

Advantages of life insurance life insurance provides a cash infusion to deal with the adverse financial consequences of the insured's death.

Yet another advantage of life insurance:

Policies that provide for cash value accumulation other types of life insurance, such as universal life, indexed universal life, and variable life, may lower the amount of coverage and/or the increase.

Other than these advantages a life insurance policy also helps a person in paying taxes.

After the death of a person who is insured, his family members receive the amount of money without taxes imposed on them.

There are advantages to specific policies that may not exist if you buy a different type of plan.

Permanent life insurance is not for everyone.

Permanent life insurance is also called cash value insurance.

This means a permanent policy builds up cash value over time.

The major advantages of buying a permanent life insurance policy are the death benefit, cash value growth, and you lock in the premium.

However, it has a couple of distinct differences of which you should be aware.

Burial insurance is much cheaper than a large life insurance plan, but there are several other advantages to it.

8 Bahan Alami Detox Ternyata Cewek Curhat Artinya SayangCegah Celaka, Waspada Bahaya Sindrom Hipersomnia6 Manfaat Anggur Merah Minuman, Simak Faktanya7 Makanan Sebabkan SembelitTak Hanya Manis, Ini 5 Manfaat Buah Sawo10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 1)Tips Jitu Deteksi Madu Palsu (Bagian 1)Jam Piket Organ Tubuh (Hati)Ternyata Mudah Kaget Tanda Gangguan MentalHowever, it has a couple of distinct differences of which you should be aware. 4 Advantages Of Life Insurance. Burial insurance is much cheaper than a large life insurance plan, but there are several other advantages to it.

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

While life insurance is cheaper than most people think it is, you'll probably still have to open your wallet to pay your life insurance premiums.

Now that we've covered the more general advantages and disadvantages of life insurance, let's talk about how the policy you choose can shake things up.

Life insurance is the financial protection plan that one buys to safeguard their family's and loved ones' financial future when the policyholder is no longer with them.

Life insurance have both advantages and disadvantages.

Buying the life insurance is one of the best decisions that everyone should make in their life.

Once you buy a life insurance for you this will be the decision on which you will never regret in your whole life but only a few people know the.

What are the advantages of life insurance policy?

Life insurance as the name itself suggests is something that insures your life with a financial support when needed the most.

Term life insurance policies are still a great option with many advantages.

As with most insurance products, the goal of a life insurance policy is to never need to use it.

This coverage offers financial protection to your loved ones several different forms of life insurance are available in today's market to help you meet the specific needs of your family.

There are many life insurance benefits worth talking about.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Meaning life insurance is the protection of a family against loss of income in case of the death of the person insured.

The policy is bought from an insurance company which will pay a fixed sum of money either at the there are many advantages and disadvantages of life insurance as discussed below.

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

Advantages of term life insurance.

The coverage lasts your whole life, so your family's financial future will remain secure.

Switching life insurance policies also doesn't generally introduce potential for additional taxation.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

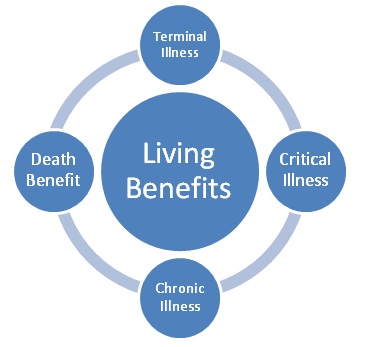

The pros and cons of living benefits life insurance include the biggest advantage, which is having cash you can borrow at.

Understand the need & advantages of life insurance & how it plays the dual role of advantages of life insurance.

Once a goal has been identified and a value for it has been crystallized, a life insurance policy is an.

While whole life premium payments in the early years are higher than those for term life, the advantages increase significantly as time passes.

Variable life insurance is another form of whole life insurance.

However, it has a couple of distinct differences of which you should be aware.

The first is that anyone can purchase.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or first and foremost, your life insurance application will get approved and secondly, your premium will be much lower.

Depending on your age and the amount of.

Cash value builds at current rate of interest.

Term life insurance has distinct advantages over other policies, but it comes with a few disadvantages as well.

Learn more in our guide.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

A good life insurance policy provides you and your family with financial security and protection unavailable from any other source.

Advantages of life insurance life insurance provides a cash infusion to deal with the adverse financial consequences of the insured's death.

Life insurance benefits from favorable tax treatment unlike any other financial instrument.

Insurance provides economic and finanicial protection to the insured against the unexpected losses in consideration of nominal amount called premium.

Aig life insurance company is one of the biggest life insurance companies in the world, with more than 88 million policyholders in 130 countries.

So here are our top four guaranteed issue life insurance companies.

This life insurance policy covers one's entire life.

This is much in demand because of its ability to provide financial protection and accrue cash value and pay dividends to the insured.

Taking a whole life insurance policy leads to a number of benefits and advantages. 4 Advantages Of Life Insurance. Few of them are listed below.5 Kuliner Nasi Khas Indonesia Yang Enak Di LidahTernyata Kamu Tidak Tau Jajanan Ini Namanya Beda Rasanya SamaWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Resep Ayam Suwir Pedas Ala CeritaKuliner7 Makanan Pembangkit LibidoTernyata Makanan Ini Sangat Berbahaya Kalau Di PenjaraCegah Alot, Ini Cara Benar Olah Cumi-CumiTernyata Asal Mula Soto Bukan Menggunakan DagingPecel Pitik, Kuliner Sakral Suku Using BanyuwangiSejarah Gudeg Jogyakarta

Comments

Post a Comment