4 Advantages Of Life Insurance There Are Advantages To Specific Policies That May Not Exist If You Buy A Different Type Of Plan.

4 Advantages Of Life Insurance. Let Us Tell You How Your Life Insurance 1,50,000 On Life Insurance Under Section 80c.

SELAMAT MEMBACA!

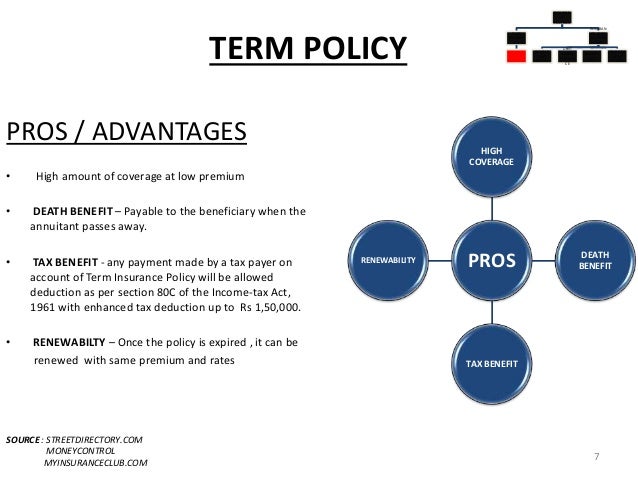

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

Let us tell you how your life insurance 1,50,000 on life insurance under section 80c.

With various types of life insurance plans available, you can plan your.

10 advantages of term life insurance.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

There are many life insurance benefits worth talking about.

However, our primary focus at i&e is on permanent cash value life insurance.

This is strikingly character demand because of its bent to provide cash protection and accrue capital value again pay dividends to the insured.

Taking a whole life insurance policy leads to a number of benefits and advantages.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

#3 — those who may.

Advantages of term life insurance.

Initially less expensive premiums than whole life insurance, which can be great if you're trying to save money right now.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

Advantages of life insurance investing.

One of the biggest advantages of investing in life insurance is that you don't pay taxes on the money until you take it out.

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

The loan amount that can be taken in a percentage of the cash value or sum assured under policy depending on the policy provisions.

A life insurance's payout should be enough for your dependents to live on if you pass on.

Understand whole life and term life insurance.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

This life protection won't vanish if premiums are paid — it's a financial product that remains in place for your entire life.

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

Permanent life insurance is not for everyone.

If you want to buy coverage for the traditional use, then the cost of permanent insurance may be much too.

Advantages & disadvantages of whole life insurance policies.

Other than these advantages a life insurance policy also helps a person in paying taxes.

A person has to pay no amount of tax on interest or other earnings.

After the death of a person who is insured, his family members receive the amount of money without taxes imposed on them.

Term coverage is the simplest form of life insurance to understand.

We all value something that is simple to understand.

Life insurance is one of the most important investments that you'll ever make for your family.

Burial insurance is much cheaper than a large life insurance plan, but there are several other advantages to it.

The first is that anyone can purchase one of these plans.

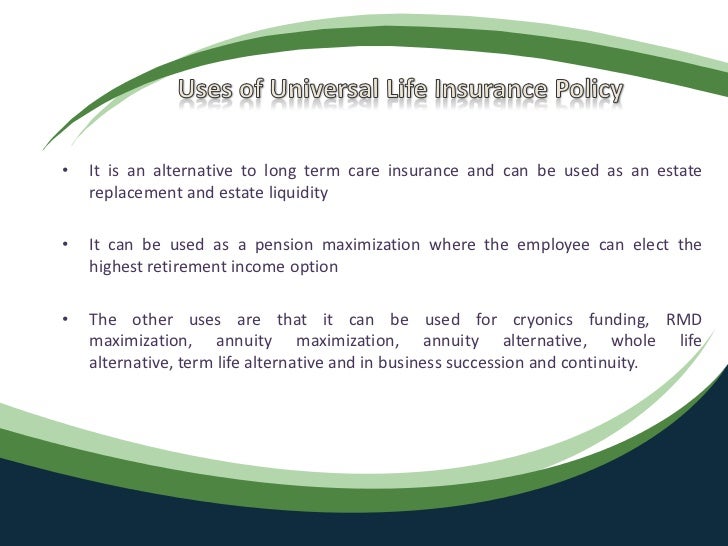

Using life insurance as an investing tool is definitely not for there was another insurance called universal life which is similar in many ways to the whole life, but here the premium payments are flexible, but again.

Life positioning of life insurance can be complex particularly if the insurance is for complex family situations, business situations and estate planning.

Permanent life insurance is also called cash value insurance.

This means a permanent policy builds up cash value over time.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you.

When you meet with a client regarding life insurance, how long does it take to do a plan, or a review with them to determine how much coverage they need and to come up.

Generally, life insurance premiums are not tax deductible.

This is where it really gets good

Tax advantages of life insurance living benefits. 4 Advantages Of Life Insurance. This is where it really gets good

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

Let us tell you how your life insurance 1,50,000 on life insurance under section 80c.

With various types of life insurance plans available, you can plan your.

10 advantages of term life insurance.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

There are many life insurance benefits worth talking about.

However, our primary focus at i&e is on permanent cash value life insurance.

This is strikingly character demand because of its bent to provide cash protection and accrue capital value again pay dividends to the insured.

Taking a whole life insurance policy leads to a number of benefits and advantages.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

#3 — those who may.

Advantages of term life insurance.

Initially less expensive premiums than whole life insurance, which can be great if you're trying to save money right now.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

Advantages of life insurance investing.

One of the biggest advantages of investing in life insurance is that you don't pay taxes on the money until you take it out.

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

The loan amount that can be taken in a percentage of the cash value or sum assured under policy depending on the policy provisions.

A life insurance's payout should be enough for your dependents to live on if you pass on.

Understand whole life and term life insurance.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

This life protection won't vanish if premiums are paid — it's a financial product that remains in place for your entire life.

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

Permanent life insurance is not for everyone.

If you want to buy coverage for the traditional use, then the cost of permanent insurance may be much too.

Advantages & disadvantages of whole life insurance policies.

Other than these advantages a life insurance policy also helps a person in paying taxes.

A person has to pay no amount of tax on interest or other earnings.

After the death of a person who is insured, his family members receive the amount of money without taxes imposed on them.

Term coverage is the simplest form of life insurance to understand.

We all value something that is simple to understand.

Life insurance is one of the most important investments that you'll ever make for your family.

Burial insurance is much cheaper than a large life insurance plan, but there are several other advantages to it.

The first is that anyone can purchase one of these plans.

Using life insurance as an investing tool is definitely not for there was another insurance called universal life which is similar in many ways to the whole life, but here the premium payments are flexible, but again.

Life positioning of life insurance can be complex particularly if the insurance is for complex family situations, business situations and estate planning.

Permanent life insurance is also called cash value insurance.

This means a permanent policy builds up cash value over time.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you.

When you meet with a client regarding life insurance, how long does it take to do a plan, or a review with them to determine how much coverage they need and to come up.

Generally, life insurance premiums are not tax deductible.

This is where it really gets good

Tax advantages of life insurance living benefits. 4 Advantages Of Life Insurance. This is where it really gets good

Comments

Post a Comment