Four Advantages Of Life Insurance In Case Of Any Untoward Happening To The Insured, The Insurer Pays Up The Entire Amount I.e.

Four Advantages Of Life Insurance. Advantages Of Term Life Insurance.

SELAMAT MEMBACA!

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

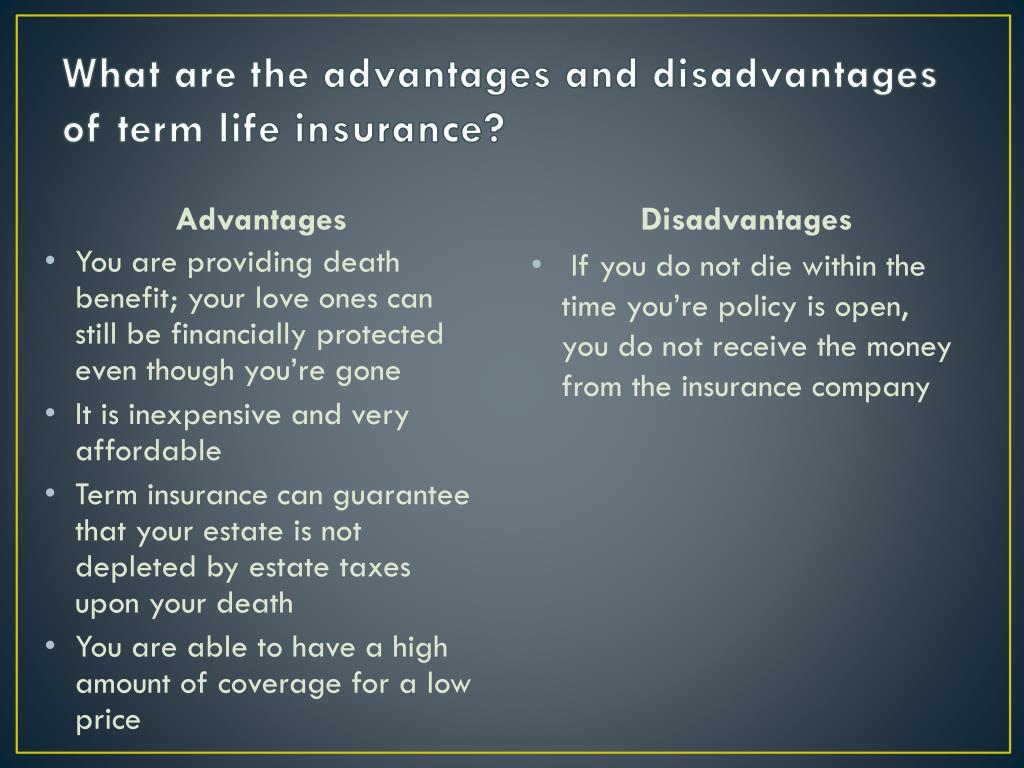

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

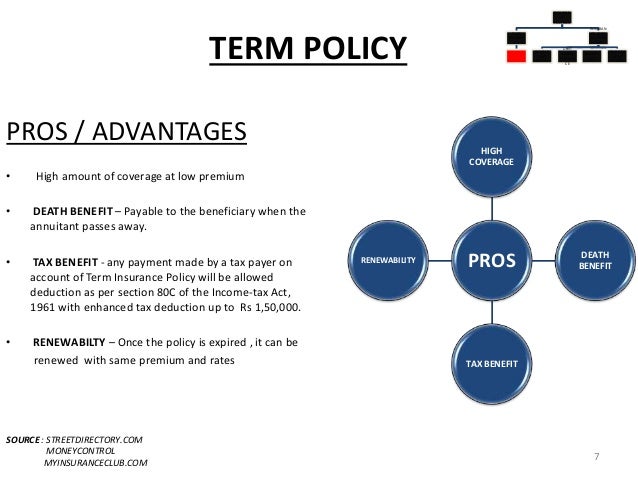

Term life insurance offers four important advantages.

Term life insurance is easy to understand, which makes it simple to shop around and compare rates.

You need to make only three main decisions:

Term life insurance policies are still a great option with many advantages.

10 advantages of term life insurance.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

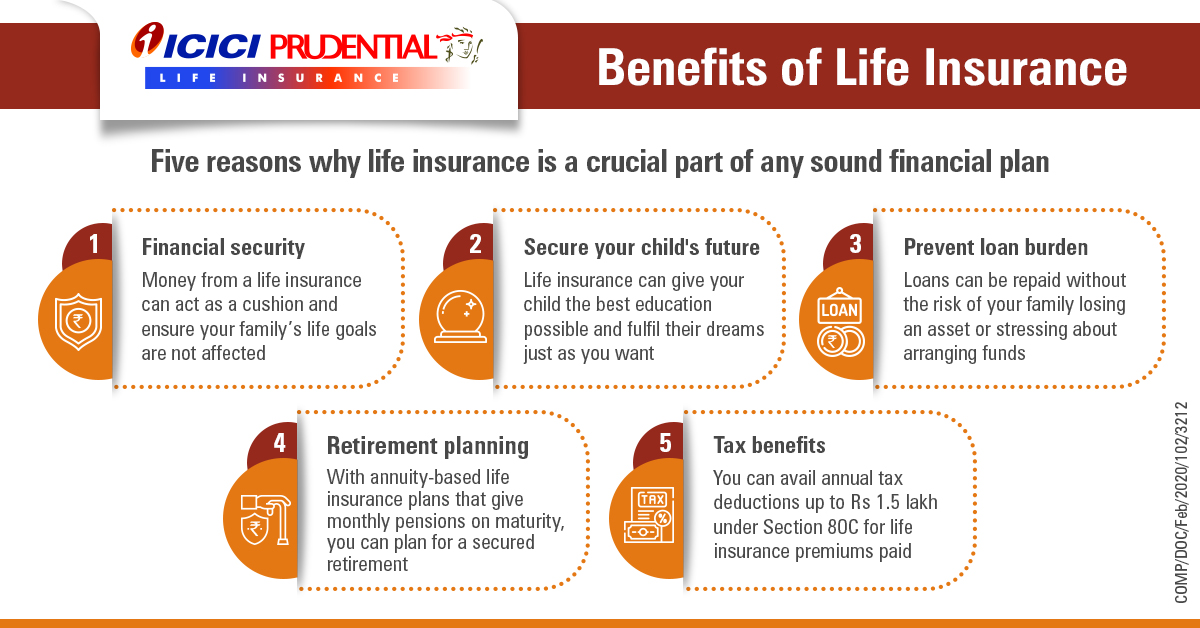

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

Forget your health, marathons, and all that.

Here are the basic questions:

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 there are four income cash value life insurance policies:

Participating whole life, current assumption universal life, indexed universal life and.

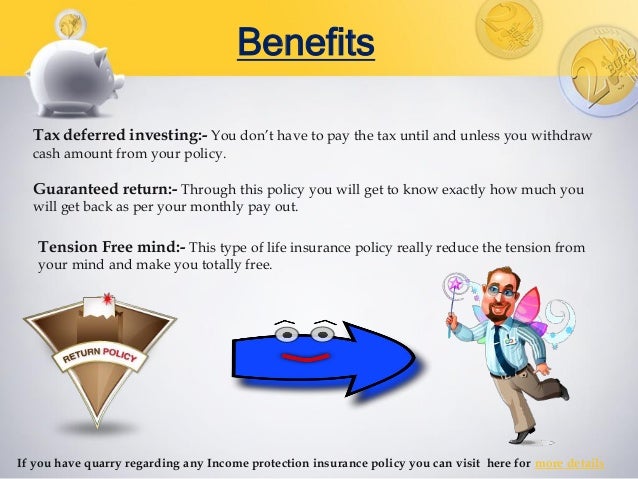

One of the biggest advantages of investing in life insurance is that you don't pay taxes on the money until you take it out.

If you keep paying premiums, you can keep the money in the account, accruing interest, until you die.

Advantages of term life insurance.

Here are some advantages and disadvantages of having life insurance and what you need to know before getting a life insurance policy.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

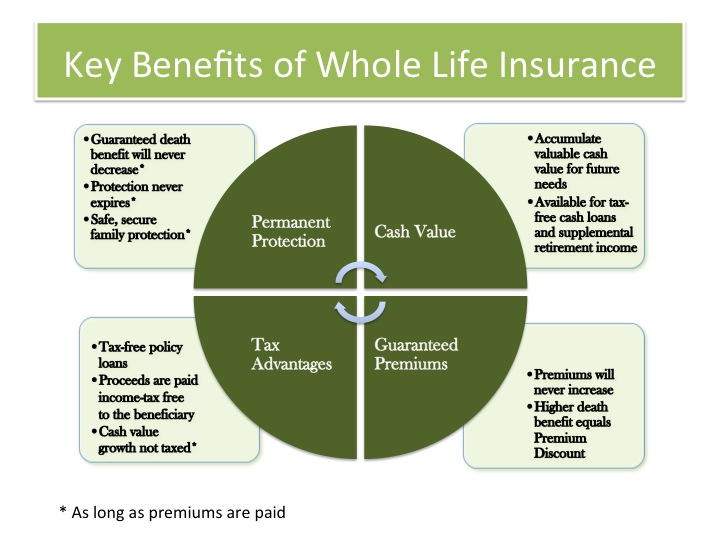

Whole life insurance is the most common form of permanent life insurance, which means that if you pay your premiums, you don't ever have to worry about your coverage expiring.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

Know the top 8 advantages of life insurance.

Investing in life insurance gives you and your family a secure future.

In case of any untoward happening to the insured, the insurer pays up the entire amount i.e.

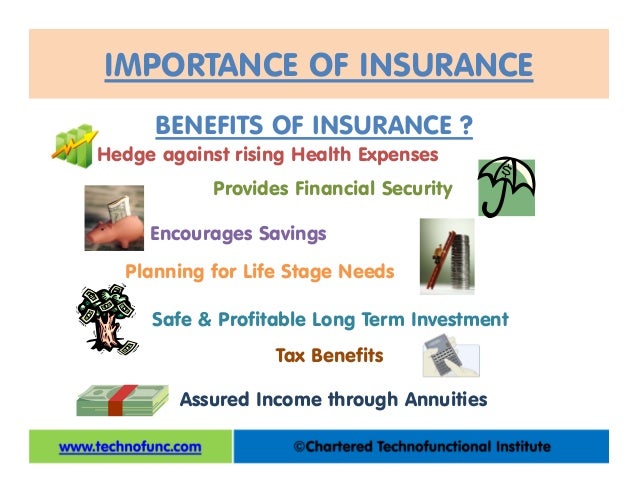

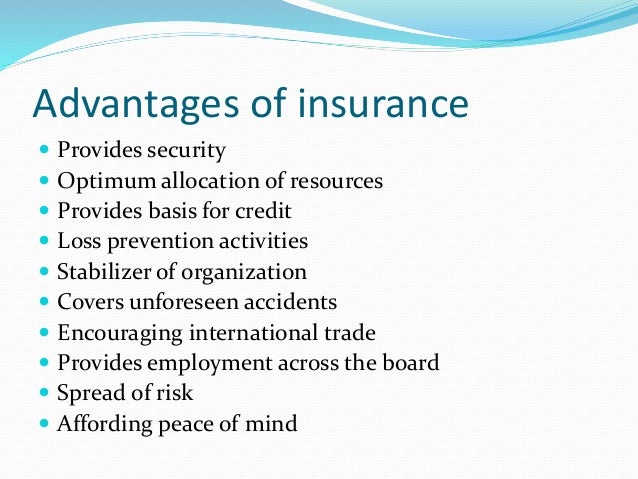

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

![Term Life Insurance: Insider Tips [Research + Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/insproviders-live/9496f87a-term_life_insurance_advantages_disadvantages.png)

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

Hdfc life insurance company limited.

Let's look at the advantages and disadvantages of term life insurance.

Whether you buy whole life or term insurance, you will still need to be in great health to get the lowest rates.

There are advantages to specific policies that may not exist if you buy a different type of plan.

Permanent life insurance is not for everyone.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you.

Are there any types of life insurance policies that someone could pay the premium, and if for some reason they didn't use it, they would be able to get their money back?

What is a universal index life insurance?universal index life insurance policies are are permanent life insurance policies, build cash value over time, and.

Tax advantages of life insurance living benefits.

This is where it really gets good

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Life insurance provides advantages and disadvantages that are not available from any other financial instrument however it also has disadvantages.

Life insurance offers an infusion of cash that is intended for dealing with the adverse financial consequences of the insured's death.

Ini Manfaat Seledri Bagi KesehatanTernyata Tahan Kentut Bikin Keracunan5 Manfaat Meredam Kaki Di Air EsGawat! Minum Air Dingin Picu Kanker!8 Bahan Alami Detox Mengusir Komedo Membandel - Bagian 27 Makanan Sebabkan SembelitResep Alami Lawan Demam AnakHindari Makanan Dan Minuman Ini Kala Perut KosongFakta Salah Kafein KopiLife insurance offers an infusion of cash that is intended for dealing with the adverse financial consequences of the insured's death. Four Advantages Of Life Insurance. More and more life insurance companies are making the application process fast and easy.

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Term life insurance policies are still a great option with many advantages.

10 advantages of term life insurance.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

With various types of life insurance plans available, you can plan your.

This is strikingly character demand because of its bent to provide cash protection and accrue capital value again pay dividends to the insured.

Taking a whole life insurance policy leads to a number of benefits and advantages.

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

Forget your health, marathons, and all that.

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

Advantages of life insurance investing.

If you keep paying premiums, you can keep the money in the account, accruing interest, until you die.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

#3 — those who may.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

This life protection won't vanish if premiums are paid — it's a financial product that remains in place for your entire life.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

Life insurance provides you the advantage of taking a policy loan in case you are in desperate need of money.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

The biggest advantage of term life is that you can purchase peace of mind at a bargain price compared to the cost of permanent life.

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

Other than these advantages a life insurance policy also helps a person in paying taxes.

A person has to pay no amount of tax on interest or other earnings.

After the death of a person who is insured, his family members receive the amount of money without taxes imposed on them.

The life insurance policy gives full financial support to the insured in his old age.

It also provides financial support to the dependent in case the death of the insured.

These funds are productively used in life insurance provides a mode of investment.

The amount of policy is paid to.

Let's look at the advantages and disadvantages of term life insurance.

Most policies expire when the insured reaches 95 years old.

However, it will be significantly more expensive, and the rate will increase every.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you.

When you meet with a client regarding life insurance, how long does it take to do a plan, or a review with them to determine how much coverage they need and to come up.

This means a permanent policy builds up cash value over time.

The major advantages of buying a permanent life insurance policy are the death benefit, cash value growth, and you lock in the premium.

Generally, life insurance premiums are not tax deductible.

This is where it really gets good

Another advantage of using an independent insurance agent is that you will be able to save money.

When you look at different choices, you can generally find one that is quite a bit cheaper than the rest.

What is a universal index life insurance?universal index life insurance policies are are permanent life insurance policies, build cash value over time, and.

Life insurance provides advantages and disadvantages that are not available from any other financial instrument however it also has disadvantages.

Life insurance provides advantages and disadvantages that are not available from any other financial instrument however it also has disadvantages. Four Advantages Of Life Insurance. Life positioning of life insurance can be complex particularly if the insurance is for complex family situations, business situations and estate planning.Resep Beef Teriyaki Ala CeritaKulinerSejarah Nasi Megono Jadi Nasi TentaraBakwan Jamur Tiram Gurih Dan NikmatKhao Neeo, Ketan Mangga Ala ThailandTernyata Bayam Adalah Sahabat WanitaNikmat Kulit Ayam, Bikin SengsaraPete, Obat Alternatif DiabetesResep Nikmat Gurih Bakso LeleWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Trik Menghilangkan Duri Ikan Bandeng

Comments

Post a Comment