4 Advantages Of Life Insurance This Life Protection Won't Vanish If Premiums Are Paid €� It's A Financial Product That Remains In Place For Your Entire Life.

4 Advantages Of Life Insurance. You Need To Make Only Three Main Decisions:

SELAMAT MEMBACA!

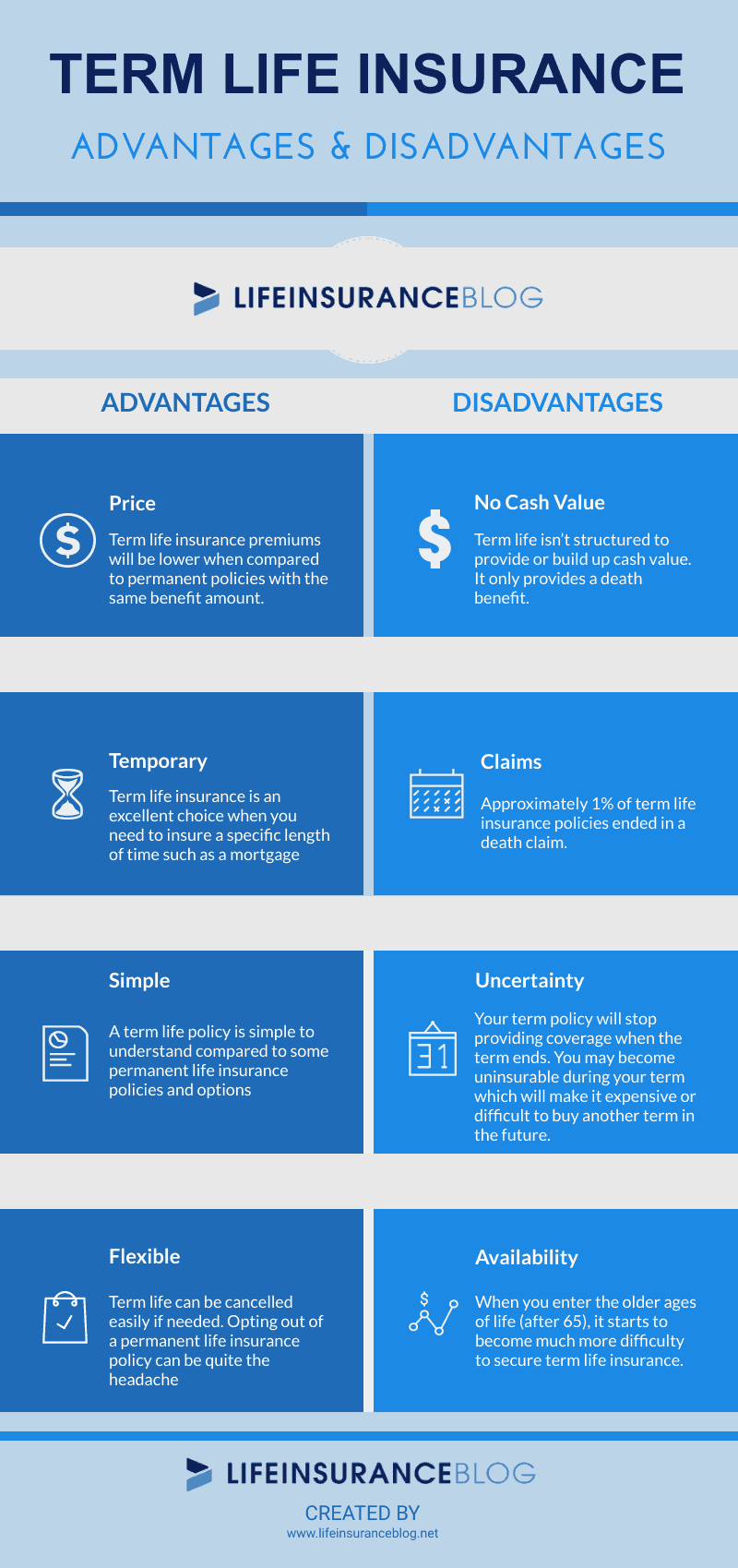

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Read on to know the benefits and drawbacks.

10 advantages of term life insurance.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

There are many life insurance benefits worth talking about.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

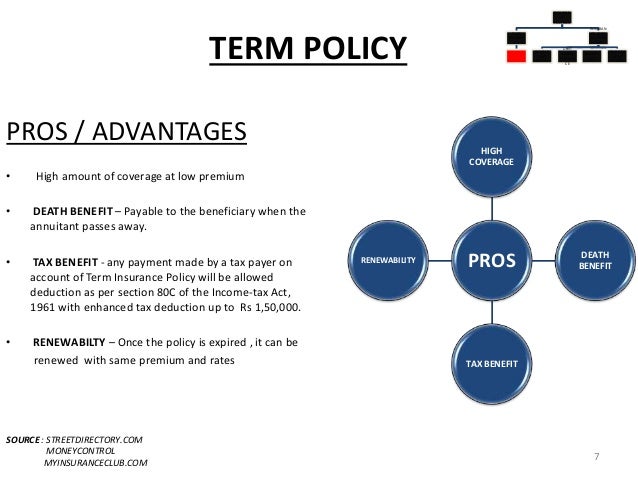

Let us tell you how your life insurance 1,50,000 on life insurance under section 80c.

This is strikingly character demand because of its bent to provide cash protection and accrue capital value again pay dividends to the insured.

Taking a whole life insurance policy leads to a number of benefits and advantages.

Forget your health, marathons, and all that.

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

Advantages of life insurance investing.

If you keep paying premiums, you can keep the money in the account, accruing interest, until you die.

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Advantages of life insurance 2.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

Advantages of term life insurance.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

#3 — those who may.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

The loan amount that can be taken in a percentage of the cash value or sum assured under policy depending on the policy provisions.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Whole life insurance, at least according to her, is a waste of resources and represents a sunk investment cost.

![Term Life Insurance: Insider Tips [Research + Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/insproviders-live/9496f87a-term_life_insurance_advantages_disadvantages.png)

Advantages & disadvantages of whole life insurance policies.

Whole life insurance has some clear advantages over other.

3whole life advantage® is a whole life insurance policy issued by allstate assurance company, 3075 sanders rd., northbrook il 60062 and is available in most states with contract series icc18ac1/nc18ac1 and rider series icc18ac2/nc18ac2, icc18ac7/nc18ac7

Hdfc life insurance company limited.

There are advantages to specific policies that may not exist if you buy a different type of plan.

Permanent life insurance is not for everyone.

Other than these advantages a life insurance policy also helps a person in paying taxes.

A person has to pay no amount of tax on interest or other earnings.

After the death of a person who is insured, his family members receive the amount of money without taxes imposed on them.

The amount of premium so collected is invested in productive sectors like trade and.

Let's look at the advantages and disadvantages of term life insurance.

Most policies expire when the insured reaches 95 years old.

However, it will be significantly more expensive, and the rate will increase every.

Generally, life insurance premiums are not tax deductible.

Tax advantages of life insurance living benefits.

Permanent life insurance is also called cash value insurance.

This means a permanent policy builds up cash value over time.

The major advantages of buying a permanent life insurance policy are the death benefit, cash value growth, and you lock in the premium.

When you meet with a client regarding life insurance, how long does it take to do a plan, or a review with them to determine how much coverage they need and to come up.

Segala Penyakit, Rebusan Ciplukan ObatnyaFakta Salah Kafein KopiCegah Celaka, Waspada Bahaya Sindrom HipersomniaVitalitas Pria, Cukup Bawang Putih SajaTernyata Tahan Kentut Bikin KeracunanPD Hancur Gegara Bau Badan, Ini Solusinya!!Ternyata Cewek Curhat Artinya SayangPentingnya Makan Setelah OlahragaTernyata Tidur Terbaik Cukup 2 Menit!Saatnya Minum Teh Daun Mint!!Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you. 4 Advantages Of Life Insurance. When you meet with a client regarding life insurance, how long does it take to do a plan, or a review with them to determine how much coverage they need and to come up.

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Read on to know the benefits and drawbacks.

10 advantages of term life insurance.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

There are many life insurance benefits worth talking about.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

Let us tell you how your life insurance 1,50,000 on life insurance under section 80c.

This is strikingly character demand because of its bent to provide cash protection and accrue capital value again pay dividends to the insured.

Taking a whole life insurance policy leads to a number of benefits and advantages.

Forget your health, marathons, and all that.

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

Advantages of life insurance investing.

If you keep paying premiums, you can keep the money in the account, accruing interest, until you die.

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Advantages of life insurance 2.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

Advantages of term life insurance.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

#3 — those who may.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

The loan amount that can be taken in a percentage of the cash value or sum assured under policy depending on the policy provisions.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Whole life insurance, at least according to her, is a waste of resources and represents a sunk investment cost.

Advantages & disadvantages of whole life insurance policies.

Whole life insurance has some clear advantages over other.

3whole life advantage® is a whole life insurance policy issued by allstate assurance company, 3075 sanders rd., northbrook il 60062 and is available in most states with contract series icc18ac1/nc18ac1 and rider series icc18ac2/nc18ac2, icc18ac7/nc18ac7

Hdfc life insurance company limited.

There are advantages to specific policies that may not exist if you buy a different type of plan.

Permanent life insurance is not for everyone.

Other than these advantages a life insurance policy also helps a person in paying taxes.

A person has to pay no amount of tax on interest or other earnings.

After the death of a person who is insured, his family members receive the amount of money without taxes imposed on them.

The amount of premium so collected is invested in productive sectors like trade and.

Let's look at the advantages and disadvantages of term life insurance.

Most policies expire when the insured reaches 95 years old.

However, it will be significantly more expensive, and the rate will increase every.

Generally, life insurance premiums are not tax deductible.

Tax advantages of life insurance living benefits.

Permanent life insurance is also called cash value insurance.

This means a permanent policy builds up cash value over time.

The major advantages of buying a permanent life insurance policy are the death benefit, cash value growth, and you lock in the premium.

When you meet with a client regarding life insurance, how long does it take to do a plan, or a review with them to determine how much coverage they need and to come up.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you. 4 Advantages Of Life Insurance. When you meet with a client regarding life insurance, how long does it take to do a plan, or a review with them to determine how much coverage they need and to come up.Waspada, Ini 5 Beda Daging Babi Dan Sapi!!Segarnya Carica, Buah Dataran Tinggi Penuh KhasiatCegah Alot, Ini Cara Benar Olah Cumi-CumiBir Pletok, Bir Halal Betawi7 Makanan Pembangkit LibidoSejarah Gudeg JogyakartaResep Ayam Suwir Pedas Ala CeritaKulinerResep Garlic Bread Ala CeritaKuliner Resep Racik Bumbu Marinasi IkanAmpas Kopi Jangan Buang! Ini Manfaatnya

Comments

Post a Comment