Four Advantages Of Life Insurance Life Insurance Has Various Advantages That Can Guarantee Your Own Financial Security And That Of Your Family As Well.

Four Advantages Of Life Insurance. Life Insurance Programmes Give Answers, Which Help Prepare For Joyful Events (a Wedding, Children's Education, Etc.) And Create A Safety Margin In The Event Of Sudden Unpleasant Developments.

SELAMAT MEMBACA!

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

Term life insurance policies are still a great option with many advantages.

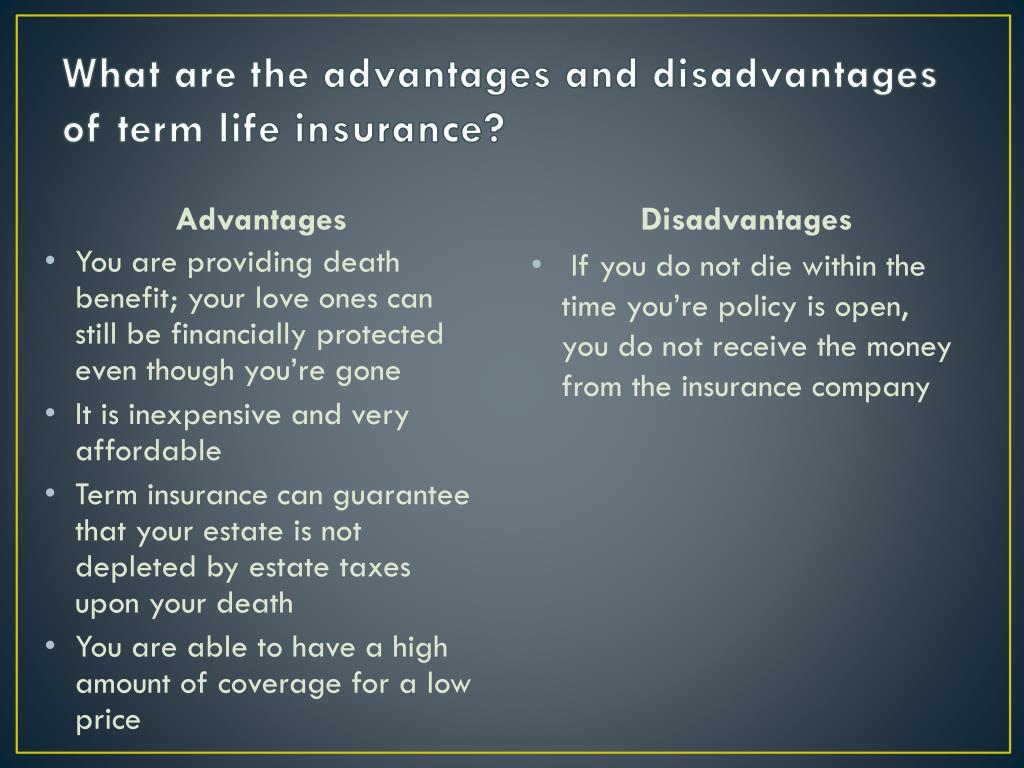

What are the advantages and disadvantages of term life insurance?

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Read on to know the benefits and drawbacks.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

Term life insurance is easy to understand, which makes it simple to shop around and compare rates.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Forget your health, marathons, and all that.

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

Some advantages of life insurance are:

Participating whole life, current assumption universal life, indexed universal life and.

Advantages of life insurance investing.

One of the biggest advantages of investing in life insurance is that you don't pay taxes on the money until you take it out.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

Let us tell you how your life your life insurance can ensure your family has a comfortable lifestyle if you are not around to support them.

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

#3 — those who may.

Whole life insurance is the most common form of permanent life insurance, which means that if you pay your premiums, you don't ever have to worry about your coverage expiring.

Know the top 8 advantages of life insurance.

Compare and buy 1 cr life cover at rs.

Investing in life insurance gives you and your family a secure future.

Switching life insurance policies also doesn't generally introduce potential for additional taxation.

For details on taxation with regards to life insurance 2.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

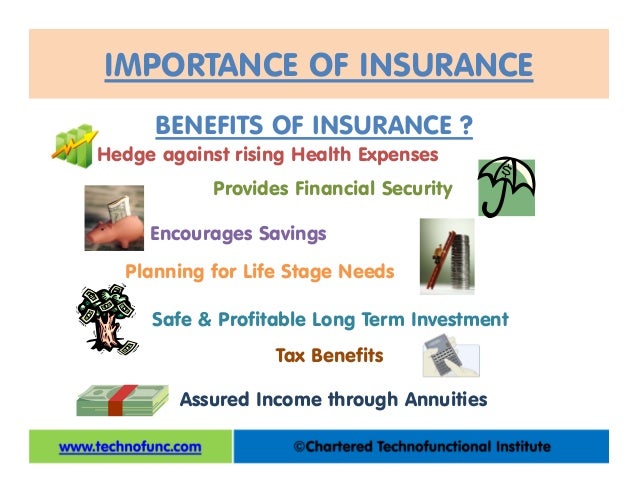

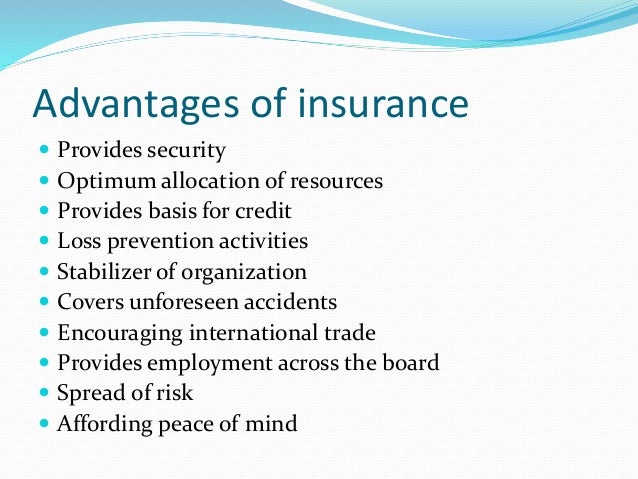

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

![Term Life Insurance: Insider Tips [Research + Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/insproviders-live/9496f87a-term_life_insurance_advantages_disadvantages.png)

Term life insurance and whole life insurance offer this benefit, although term insurance places a limit on how long the coverage will remain in force.

Beyond your insurance company's sheer financial strength, you have four safety nets to help guarantee the company will be able to pay its claims.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Are there any types of life insurance policies that someone could pay the premium, and if for some reason they didn't use it, they would be able to get their money back?

Let's look at the advantages and disadvantages of term life insurance.

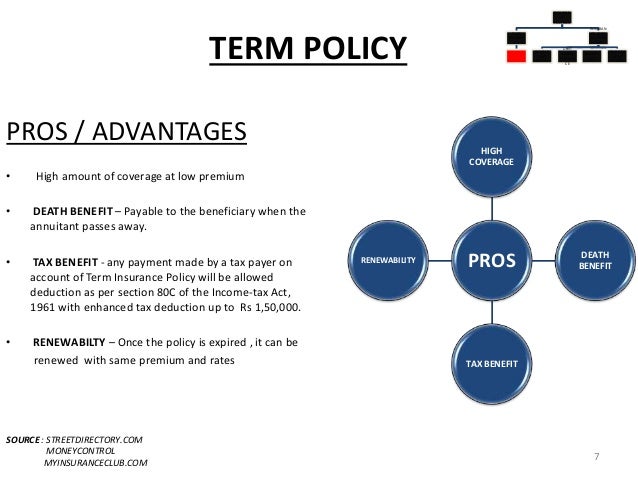

Term life insurance is probably the most popular form of protection because of its lowest cost.

Other than these advantages a life insurance policy also helps a person in paying taxes.

A person has to pay no amount of tax on interest or other earnings.

After the death of a person who is insured, his family members receive the amount of money without taxes imposed on them.

Permanent life insurance is not for everyone.

If you want to buy coverage for the traditional use, then the cost of permanent insurance may be much too.

Life insurance provides advantages and disadvantages that are not available from any other financial instrument however it also has disadvantages.

Life insurance as an investment:

Suppose you were a 75 year old woman and bought a $500,000 lifetime guaranteed policy advantages of an ilit.

Ilit trusts are especially advantageous for several reasons.

Life insurance can be more than a safety net — it can be the foundation of a good financial plan.

Get only the life insurance you need and nothing you don't.

Aaa, aaa, and aa+ the highest financial strength ratings of any life insurer from all four major rating agencies3.

Life insurance practically meets the goals and the requirements of each specific person in a certain.

Life insurance has special tax advantages that can be utilized to create extraordinary results.

Mana Yang Lebih Sehat, Teh Hitam VS Teh Hijau?Fakta Salah Kafein KopiTernyata Tidur Terbaik Cukup 2 Menit!Manfaat Kunyah Makanan 33 Kali5 Khasiat Buah Tin, Sudah Teruji Klinis!!Tips Jitu Deteksi Madu Palsu (Bagian 1)Ini Manfaat Seledri Bagi KesehatanTernyata Tidur Bisa Buat Meninggal6 Khasiat Cengkih, Yang Terakhir Bikin HebohCegah Celaka, Waspada Bahaya Sindrom HipersomniaTheir plans are structured to have very large contributions, but typically contributions are only made for four to ten years. Four Advantages Of Life Insurance. A profession athlete may retire by the time he/she is age 30 and can start taking his/her.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

Term life insurance policies are still a great option with many advantages.

What are the advantages and disadvantages of term life insurance?

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Read on to know the benefits and drawbacks.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

Term life insurance is easy to understand, which makes it simple to shop around and compare rates.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Forget your health, marathons, and all that.

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

Some advantages of life insurance are:

Participating whole life, current assumption universal life, indexed universal life and.

Advantages of life insurance investing.

One of the biggest advantages of investing in life insurance is that you don't pay taxes on the money until you take it out.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

Let us tell you how your life your life insurance can ensure your family has a comfortable lifestyle if you are not around to support them.

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

#3 — those who may.

Whole life insurance is the most common form of permanent life insurance, which means that if you pay your premiums, you don't ever have to worry about your coverage expiring.

Know the top 8 advantages of life insurance.

Compare and buy 1 cr life cover at rs.

Investing in life insurance gives you and your family a secure future.

Switching life insurance policies also doesn't generally introduce potential for additional taxation.

For details on taxation with regards to life insurance 2.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

Term life insurance and whole life insurance offer this benefit, although term insurance places a limit on how long the coverage will remain in force.

Beyond your insurance company's sheer financial strength, you have four safety nets to help guarantee the company will be able to pay its claims.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Are there any types of life insurance policies that someone could pay the premium, and if for some reason they didn't use it, they would be able to get their money back?

Let's look at the advantages and disadvantages of term life insurance.

Term life insurance is probably the most popular form of protection because of its lowest cost.

Other than these advantages a life insurance policy also helps a person in paying taxes.

A person has to pay no amount of tax on interest or other earnings.

After the death of a person who is insured, his family members receive the amount of money without taxes imposed on them.

Permanent life insurance is not for everyone.

If you want to buy coverage for the traditional use, then the cost of permanent insurance may be much too.

Life insurance provides advantages and disadvantages that are not available from any other financial instrument however it also has disadvantages.

Life insurance as an investment:

Suppose you were a 75 year old woman and bought a $500,000 lifetime guaranteed policy advantages of an ilit.

Ilit trusts are especially advantageous for several reasons.

Life insurance can be more than a safety net — it can be the foundation of a good financial plan.

Get only the life insurance you need and nothing you don't.

Aaa, aaa, and aa+ the highest financial strength ratings of any life insurer from all four major rating agencies3.

Life insurance practically meets the goals and the requirements of each specific person in a certain.

Life insurance has special tax advantages that can be utilized to create extraordinary results.

Their plans are structured to have very large contributions, but typically contributions are only made for four to ten years. Four Advantages Of Life Insurance. A profession athlete may retire by the time he/she is age 30 and can start taking his/her.Stop Merendam Teh Celup Terlalu Lama!Kuliner Jangkrik Viral Di JepangBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi LuwakSejarah Kedelai Menjadi Tahu5 Makanan Pencegah Gangguan PendengaranSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanResep Segar Nikmat Bihun Tom YamTips Memilih Beras BerkualitasResep Garlic Bread Ala CeritaKuliner Ikan Tongkol Bikin Gatal? Ini Penjelasannya

Comments

Post a Comment