Four Advantages Of Life Insurance Term Life Insurance Is Easy To Understand, Which Makes It Simple To Shop Around And Compare Rates.

Four Advantages Of Life Insurance. Aaa, Aaa, And Aa+ The Highest Financial Strength Ratings Of Any Life Insurer From All Four Major Rating Agencies3.

SELAMAT MEMBACA!

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

4 advantages of life insurance.

10/01/2015 07:31 pm et updated oct 01, 2016.

Whether it is a nonliving product like a car or it about our own health, we don't want.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Term life insurance offers four important advantages.

Term life insurance is easy to understand, which makes it simple to shop around and compare rates.

You need to make only three main decisions:

Term life insurance policies are still a great option with many advantages.

10 advantages of term life insurance.

There are many life insurance benefits worth talking about.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

Some advantages of life insurance are:

Participating whole life, current assumption universal life, indexed universal life and.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

Let us tell you how your life your life insurance can ensure your family has a comfortable lifestyle if you are not around to support them.

Here are the basic questions:

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

One of the biggest advantages of investing in life insurance is that you don't pay taxes on the money until you take it out.

If you keep paying premiums, you can keep the money in the account, accruing interest, until you die.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

Here are some advantages and disadvantages of having life insurance and what you need to know before getting a life insurance policy.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their.

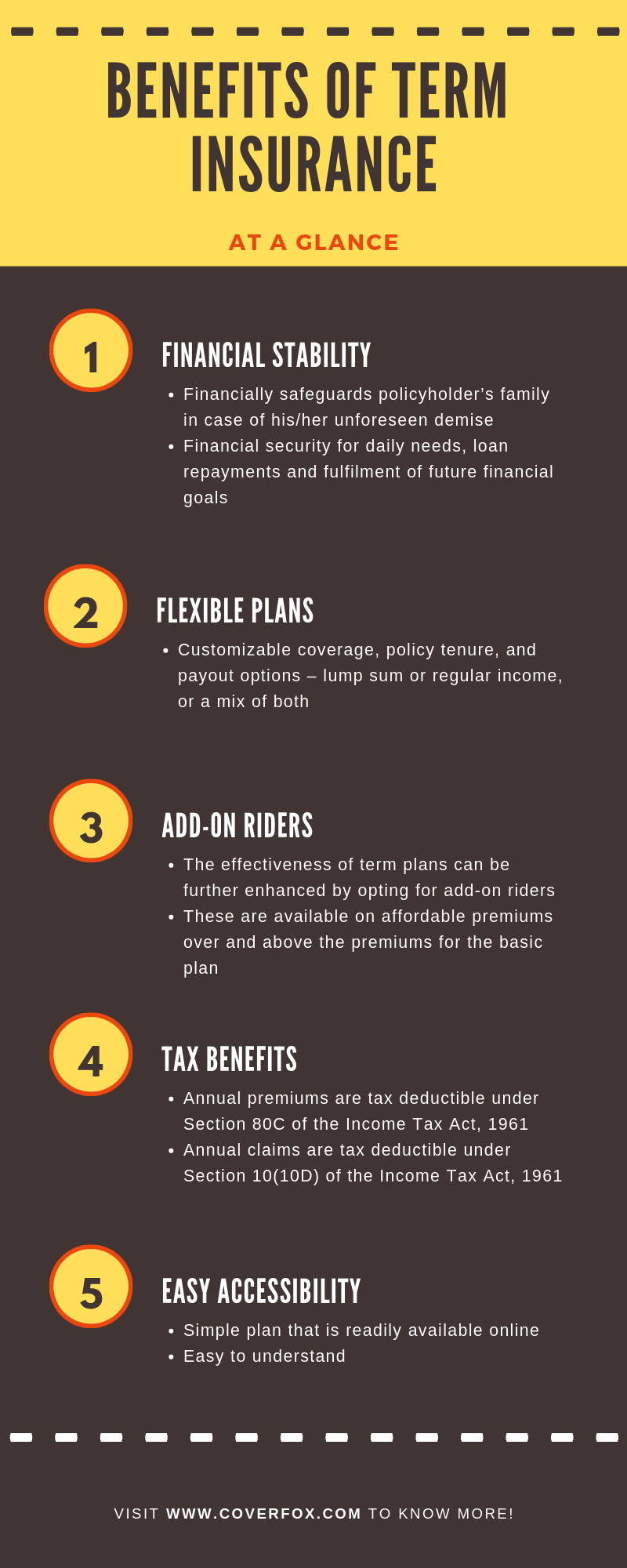

Advantages of term life insurance.

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

Insurance provides economic and finanicial protection to the insured against the unexpected losses in consideration of nominal amount called premium.

Whole life insurance is the most common form of permanent life insurance, which means that if you pay your premiums, you don't ever have to worry about your coverage expiring.

Know the top 8 advantages of life insurance.

Compare and buy 1 cr life cover at rs.

Investing in life insurance gives you and your family a secure future.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

Understand whole life and term life insurance.

In either case, the advantage of whole life insurance over term insurance is that, even if you terminate and surrender the policy, you can get back some of the.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Hdfc life insurance company limited.

Let's look at the advantages and disadvantages of term life insurance.

Term life insurance is probably the most popular form of protection because of its lowest cost.

Generally, life insurance premiums are not tax deductible.

Tax advantages of life insurance living benefits.

This is where it really gets good

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Life insurance offers an infusion of cash that is intended for dealing with the adverse financial consequences of the insured's death.

Here are four types of life insurance for you to consider.

Burial insurance is much cheaper than a large life insurance plan, but there are several other advantages to it.

Life insurance has special tax advantages that can be utilized to create extraordinary results.

Their plans are structured to have very large contributions, but typically contributions are only made for four to ten years.

A profession athlete may retire by the time he/she is age 30 and can start taking his/her.

Get only the life insurance you need and nothing you don't.

Aaa, aaa, and aa+ the highest financial strength ratings of any life insurer from all four major rating agencies3.

An insurance company, which sells the insurance to insured or policyholder, is called as insurer.

Money saved at the time of earning life and that money will be utilized after retirement.

8 Bahan Alami Detox Vitalitas Pria, Cukup Bawang Putih Saja4 Manfaat Minum Jus Tomat Sebelum TidurCara Baca Tanggal Kadaluarsa Produk MakananTernyata Menikmati Alam Bebas Ada Manfaatnya5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuTernyata Tidur Bisa Buat MeninggalPentingnya Makan Setelah OlahragaSalah Pilih Sabun, Ini Risikonya!!!6 Khasiat Cengkih, Yang Terakhir Bikin HebohInsurance is one of the instruments for retirement planning. Four Advantages Of Life Insurance. Money saved at the time of earning life and that money will be utilized after retirement.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

4 advantages of life insurance.

10/01/2015 07:31 pm et updated oct 01, 2016.

Whether it is a nonliving product like a car or it about our own health, we don't want.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Term life insurance offers four important advantages.

Term life insurance is easy to understand, which makes it simple to shop around and compare rates.

You need to make only three main decisions:

Term life insurance policies are still a great option with many advantages.

10 advantages of term life insurance.

There are many life insurance benefits worth talking about.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

Some advantages of life insurance are:

Participating whole life, current assumption universal life, indexed universal life and.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

Let us tell you how your life your life insurance can ensure your family has a comfortable lifestyle if you are not around to support them.

Here are the basic questions:

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

One of the biggest advantages of investing in life insurance is that you don't pay taxes on the money until you take it out.

If you keep paying premiums, you can keep the money in the account, accruing interest, until you die.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

Here are some advantages and disadvantages of having life insurance and what you need to know before getting a life insurance policy.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their.

Advantages of term life insurance.

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

Insurance provides economic and finanicial protection to the insured against the unexpected losses in consideration of nominal amount called premium.

Whole life insurance is the most common form of permanent life insurance, which means that if you pay your premiums, you don't ever have to worry about your coverage expiring.

Know the top 8 advantages of life insurance.

Compare and buy 1 cr life cover at rs.

Investing in life insurance gives you and your family a secure future.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

Understand whole life and term life insurance.

In either case, the advantage of whole life insurance over term insurance is that, even if you terminate and surrender the policy, you can get back some of the.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Hdfc life insurance company limited.

Let's look at the advantages and disadvantages of term life insurance.

Term life insurance is probably the most popular form of protection because of its lowest cost.

Generally, life insurance premiums are not tax deductible.

Tax advantages of life insurance living benefits.

This is where it really gets good

Life insurance offers an infusion of cash that is intended for dealing with the adverse financial consequences of the insured's death.

Here are four types of life insurance for you to consider.

Burial insurance is much cheaper than a large life insurance plan, but there are several other advantages to it.

Life insurance has special tax advantages that can be utilized to create extraordinary results.

Their plans are structured to have very large contributions, but typically contributions are only made for four to ten years.

A profession athlete may retire by the time he/she is age 30 and can start taking his/her.

Get only the life insurance you need and nothing you don't.

Aaa, aaa, and aa+ the highest financial strength ratings of any life insurer from all four major rating agencies3.

An insurance company, which sells the insurance to insured or policyholder, is called as insurer.

Money saved at the time of earning life and that money will be utilized after retirement.

Insurance is one of the instruments for retirement planning. Four Advantages Of Life Insurance. Money saved at the time of earning life and that money will be utilized after retirement.Waspada, Ini 5 Beda Daging Babi Dan Sapi!!Cegah Alot, Ini Cara Benar Olah Cumi-CumiResep Ayam Kecap Ala CeritaKuliner5 Makanan Pencegah Gangguan PendengaranTernyata Inilah Makanan Indonesia Yang Tertulis Dalam Prasasti9 Jenis-Jenis Kurma TerfavoritBir Pletok, Bir Halal Betawi3 Cara Pengawetan CabaiResep Garlic Bread Ala CeritaKuliner Segarnya Carica, Buah Dataran Tinggi Penuh Khasiat

Comments

Post a Comment