Identify 4 Advantages Of Life Insurance It Is Designed To Provide Affordable Death Protection For The Short Term And Pays A Benefit Only If If You Are Shopping For Life Insurance, There Are Compelling Reasons Why You Should Consider Term Life Insurance.

Identify 4 Advantages Of Life Insurance. When You Own A Life Insurance Policy And You Pass Away, The Beneficiaries That Are Named On Your Term Policy Will Get.

SELAMAT MEMBACA!

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

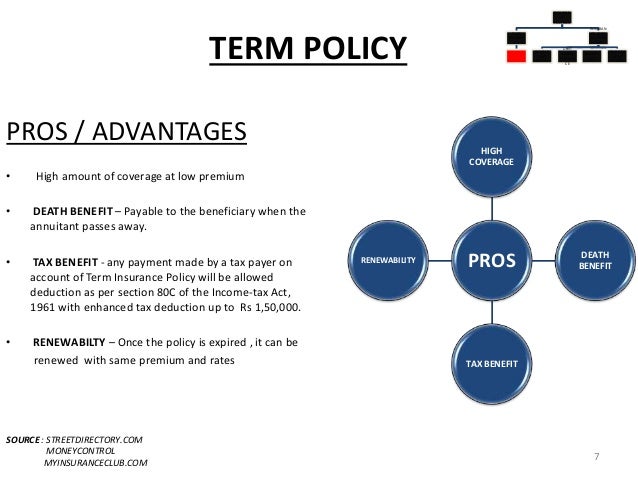

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

While life insurance is cheaper than most people think it is, you'll probably still have to open your wallet to pay your life insurance premiums.

Now that we've covered the more general advantages and disadvantages of life insurance, let's talk about how the policy you choose can shake things up.

Term life insurance policies are still a great option with many advantages.

Meaning life insurance is the protection of a family against loss of income in case of the death of the person insured.

The policy is bought from an insurance company which will pay a fixed sum of money either at the there are many advantages and disadvantages of life insurance as discussed below.

Life insurance comes with great benefits and a few disadvantages.

But let's take some time to dive into what.

As with most insurance products, the goal of a life insurance policy is to never need to use it.

This coverage offers financial protection to your loved ones several different forms of life insurance are available in today's market to help you meet the specific needs of your family.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

Lets insured adjust level of protection and cost of premiums.

Cash value builds at current rate of interest.

Switching life insurance policies also doesn't generally introduce potential for additional taxation.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or first and foremost, your life insurance application will get approved and secondly, your premium will be much lower.

Depending on your age and the amount of.

Understand the need & advantages of life insurance & how it plays the dual role of advantages of life insurance.

Advantages of term life insurance.

Initially less expensive premiums than whole life insurance advantages of whole life insurance.

The coverage lasts your whole life, so your family's financial future will remain secure.

Term life insurance has distinct advantages over other policies, but it comes with a few disadvantages as well.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

In a term life insurance policy, the life insurance protection expires whenever the selected term renewing your term life insurance policy at that later stage in life would almost certainly cost while whole life premium payments in the early years are higher than those for term life, the advantages.

Most of the life insurance schemes offer bonuses that no other investment scheme can offer.

The money invested in life insurance is safe and covers risks.

Term life insurance is the most basic form of life insurance.

Some of these reasons include.

For term life insurance, the advantages include having financial protection for your loved ones, while the disadvantages include having nothing to show for the premiums you've paid.

The pros and cons of living benefits life insurance include the biggest advantage, which is having cash you can borrow at.

Do you want to know advantages of life insurance corporation or advantages of insurance policy?

Let's look at the advantages and disadvantages of term life insurance.

Term life insurance is probably the most popular form of protection because of its lowest cost.

Life insurance you can't be turned down for sounds too good to be true.

Guaranteed acceptance life insurance is one of the most expensive ways to buy life insurance.

Unless you have serious health conditions that would get you declined for other policies, look into other policy types first.

Whole life insurance has some clear advantages over other.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you.

Are there any types of life insurance policies that someone could pay the premium, and if for some reason they didn't use it, they would be able to get their money back?

You can save time and energy and also avoid unnecessary embarrassment of negating a life insurance advisor's quote by going online.

Generally, life insurance premiums are not tax deductible.

Fakta Salah Kafein KopiPD Hancur Gegara Bau Badan, Ini Solusinya!!Tips Jitu Deteksi Madu Palsu (Bagian 1)Vitalitas Pria, Cukup Bawang Putih Saja3 X Seminggu Makan Ikan, Penyakit Kronis MinggatObat Hebat, Si Sisik NagaTernyata Jangan Sering Mandikan BayiTernyata Tidur Terbaik Cukup 2 Menit!4 Manfaat Minum Jus Tomat Sebelum TidurSaatnya Minum Teh Daun Mint!!Tax advantages of life insurance living benefits. Identify 4 Advantages Of Life Insurance. This is where it really gets good

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

While life insurance is cheaper than most people think it is, you'll probably still have to open your wallet to pay your life insurance premiums.

Now that we've covered the more general advantages and disadvantages of life insurance, let's talk about how the policy you choose can shake things up.

Term life insurance policies are still a great option with many advantages.

Meaning life insurance is the protection of a family against loss of income in case of the death of the person insured.

The policy is bought from an insurance company which will pay a fixed sum of money either at the there are many advantages and disadvantages of life insurance as discussed below.

Life insurance comes with great benefits and a few disadvantages.

But let's take some time to dive into what.

As with most insurance products, the goal of a life insurance policy is to never need to use it.

This coverage offers financial protection to your loved ones several different forms of life insurance are available in today's market to help you meet the specific needs of your family.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

Lets insured adjust level of protection and cost of premiums.

Cash value builds at current rate of interest.

Switching life insurance policies also doesn't generally introduce potential for additional taxation.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or first and foremost, your life insurance application will get approved and secondly, your premium will be much lower.

Depending on your age and the amount of.

Understand the need & advantages of life insurance & how it plays the dual role of advantages of life insurance.

Advantages of term life insurance.

Initially less expensive premiums than whole life insurance advantages of whole life insurance.

The coverage lasts your whole life, so your family's financial future will remain secure.

Term life insurance has distinct advantages over other policies, but it comes with a few disadvantages as well.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

In a term life insurance policy, the life insurance protection expires whenever the selected term renewing your term life insurance policy at that later stage in life would almost certainly cost while whole life premium payments in the early years are higher than those for term life, the advantages.

Most of the life insurance schemes offer bonuses that no other investment scheme can offer.

The money invested in life insurance is safe and covers risks.

Term life insurance is the most basic form of life insurance.

Some of these reasons include.

For term life insurance, the advantages include having financial protection for your loved ones, while the disadvantages include having nothing to show for the premiums you've paid.

The pros and cons of living benefits life insurance include the biggest advantage, which is having cash you can borrow at.

Do you want to know advantages of life insurance corporation or advantages of insurance policy?

Let's look at the advantages and disadvantages of term life insurance.

Term life insurance is probably the most popular form of protection because of its lowest cost.

Life insurance you can't be turned down for sounds too good to be true.

Guaranteed acceptance life insurance is one of the most expensive ways to buy life insurance.

Unless you have serious health conditions that would get you declined for other policies, look into other policy types first.

Whole life insurance has some clear advantages over other.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you.

Are there any types of life insurance policies that someone could pay the premium, and if for some reason they didn't use it, they would be able to get their money back?

You can save time and energy and also avoid unnecessary embarrassment of negating a life insurance advisor's quote by going online.

Generally, life insurance premiums are not tax deductible.

Tax advantages of life insurance living benefits. Identify 4 Advantages Of Life Insurance. This is where it really gets goodResep Cumi Goreng Tepung MantulCegah Alot, Ini Cara Benar Olah Cumi-CumiFoto Di Rumah Makan PadangSejarah Gudeg JogyakartaPetis, Awalnya Adalah Upeti Untuk Raja3 Cara Pengawetan CabaiResep Ayam Suwir Pedas Ala CeritaKuliner5 Cara Tepat Simpan TelurBuat Sendiri Minuman Detoxmu!!Kuliner Jangkrik Viral Di Jepang

Comments

Post a Comment