4 Advantages Of Life Insurance Life Insurance Is One Of The Most Important Investments That You'll Ever Make For Your Family.

4 Advantages Of Life Insurance. Term Life Insurance Is One Type Of Coverage That Provides Your Loved Ones Financial Protection If You Were To Die.

SELAMAT MEMBACA!

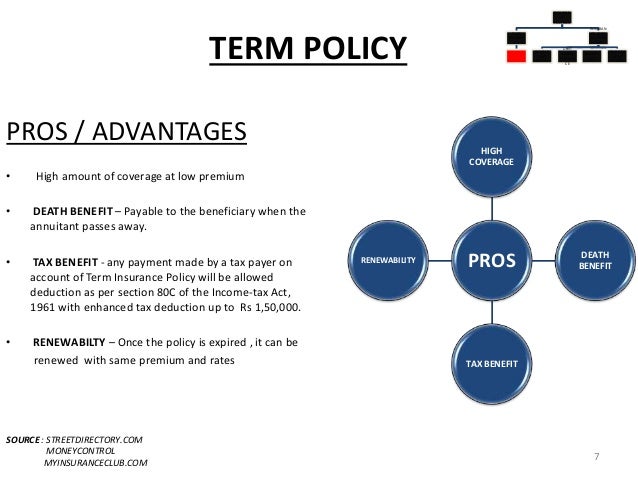

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

Term life insurance is one type of coverage that provides your loved ones financial protection if you were to die.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

Let us tell you how your life insurance 1,50,000 on life insurance under section 80c.

With various types of life insurance plans available, you can plan your.

10 advantages of term life insurance.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

There are many life insurance benefits worth talking about.

However, our primary focus at i&e is on permanent cash value life insurance.

This is strikingly character demand because of its bent to provide cash protection and accrue capital value again pay dividends to the insured.

Taking a whole life insurance policy leads to a number of benefits and advantages.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

#3 — those who may.

Advantages of term life insurance.

Initially less expensive premiums than whole life insurance, which can be great if you're trying to save money right now.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

Advantages of life insurance investing.

One of the biggest advantages of investing in life insurance is that you don't pay taxes on the money until you take it out.

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

The loan amount that can be taken in a percentage of the cash value or sum assured under policy depending on the policy provisions.

A life insurance's payout should be enough for your dependents to live on if you pass on.

Understand whole life and term life insurance.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

This life protection won't vanish if premiums are paid — it's a financial product that remains in place for your entire life.

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

Permanent life insurance is not for everyone.

If you want to buy coverage for the traditional use, then the cost of permanent insurance may be much too.

Advantages & disadvantages of whole life insurance policies.

Other than these advantages a life insurance policy also helps a person in paying taxes.

A person has to pay no amount of tax on interest or other earnings.

After the death of a person who is insured, his family members receive the amount of money without taxes imposed on them.

Term coverage is the simplest form of life insurance to understand.

We all value something that is simple to understand.

Life insurance is one of the most important investments that you'll ever make for your family.

Burial insurance is much cheaper than a large life insurance plan, but there are several other advantages to it.

The first is that anyone can purchase one of these plans.

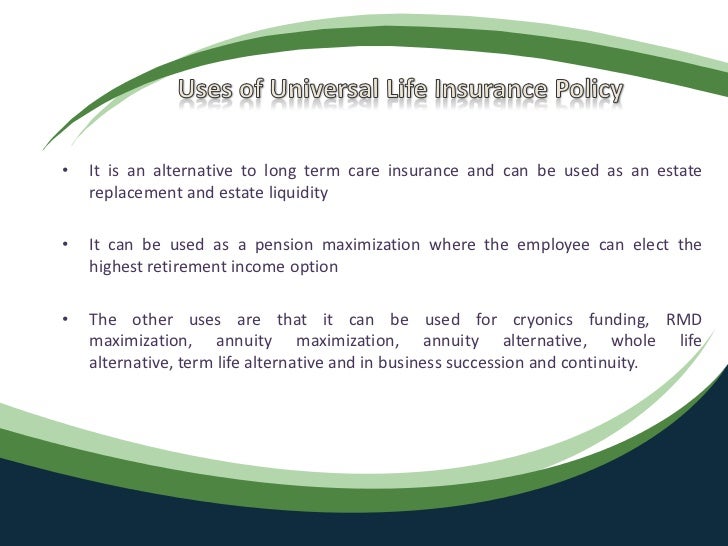

Using life insurance as an investing tool is definitely not for there was another insurance called universal life which is similar in many ways to the whole life, but here the premium payments are flexible, but again.

Life positioning of life insurance can be complex particularly if the insurance is for complex family situations, business situations and estate planning.

Permanent life insurance is also called cash value insurance.

This means a permanent policy builds up cash value over time.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you.

When you meet with a client regarding life insurance, how long does it take to do a plan, or a review with them to determine how much coverage they need and to come up.

Generally, life insurance premiums are not tax deductible.

This is where it really gets good

Tax advantages of life insurance living benefits. 4 Advantages Of Life Insurance. This is where it really gets good

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

While life insurance is cheaper than most people think it is, you'll probably still have to open your wallet to pay your life insurance premiums.

Now that we've covered the more general advantages and disadvantages of life insurance, let's talk about how the policy you choose can shake things up.

Term life insurance policies are still a great option with many advantages.

As with most insurance products, the goal of a life insurance policy is to never need to use it.

This coverage offers financial protection to your loved ones several different forms of life insurance are available in today's market to help you meet the specific needs of your family.

A life insurance's payout should be enough for your dependents to live on if you pass on.

In either case, the advantage of whole life insurance over term insurance is that, even if you terminate and surrender the policy, you can get back some of the.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or first and foremost, your life insurance application will get approved and secondly, your premium will be much lower.

Depending on your age and the amount of.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Switching life insurance policies also doesn't generally introduce potential for additional taxation.

Lets insured adjust level of protection and cost of premiums.

Cash value builds at current rate of interest.

Advantages of term life insurance.

The coverage lasts your whole life, so your family's financial future will remain secure.

You can build cash value or equity in a way that you can't with term life plans.

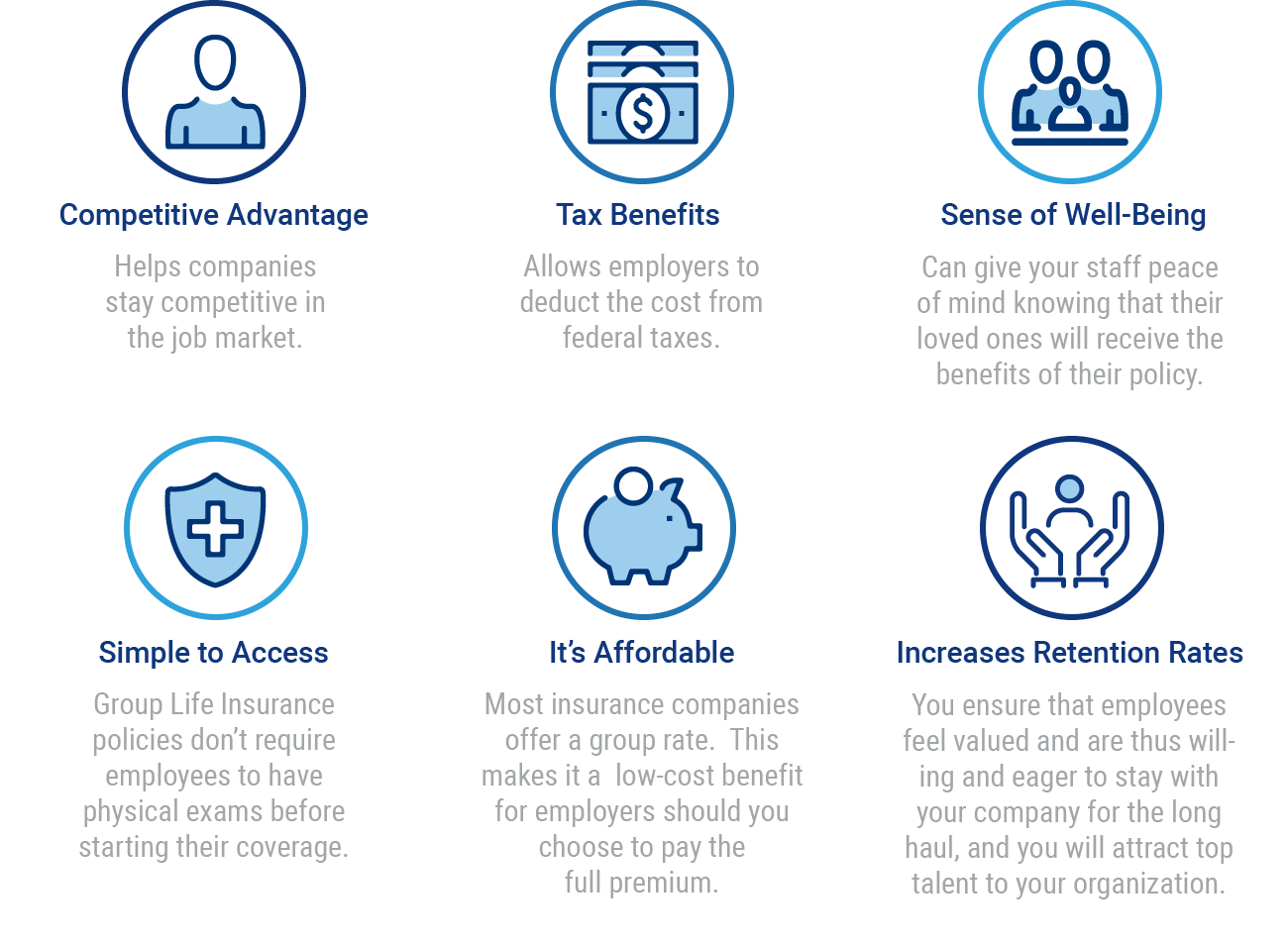

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

Understand the need & advantages of life insurance & how it plays the dual role of advantages of life insurance.

Once a goal has been identified and a value for it has been crystallized, a life insurance policy is an.

For term life insurance, the advantages include having financial protection for your loved ones, while the disadvantages include having nothing to show for the premiums you've paid.

In a term life insurance policy, the life insurance protection expires whenever the selected term renewing your term life insurance policy at that later stage in life would almost certainly cost while whole life premium payments in the early years are higher than those for term life, the advantages.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Variable life insurance is another form of whole life insurance.

However, it has a couple of distinct differences of which you should be aware.

Burial insurance is much cheaper than a large life insurance plan, but there are several other advantages to it.

Term life insurance has distinct advantages over other policies, but it comes with a few disadvantages as well.

Learn more in our guide.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Whole life insurance has some clear advantages over other.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Life insurance you can't be turned down for sounds too good to be true.

Unless you have serious health conditions that would get you declined for other policies, look into other policy types first.

The advantages of life insurance and how having life insurance is ensuring the financial security of your family, in case anything should happen to you suddenly.

You can save time and energy and also avoid unnecessary embarrassment of negating a life insurance advisor's quote by going online.

Term life insurance is probably the most popular form of protection because of its lowest cost.

Whether you buy whole life or term insurance, you will still need to be in great health to get the lowest rates.

Whole life insurance provides coverage for the life of the policy (age 121).

A guaranteed life insurance policy is always whole life insurance.

We've checked, and every single company guaranteed whole life insurance is no exception to this rule.

If you wish to purchase a once you identify which company will offer you the lowest price, sign up asap so you can start.

Insurance is one of the instruments for retirement planning.

Money saved at the time of earning life and that money will be utilized after retirement.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you. 4 Advantages Of Life Insurance. Are there any types of life insurance policies that someone could pay the premium, and if for some reason they didn't use it, they would be able to get their money back?

Comments

Post a Comment