Four Advantages Of Life Insurance Forget Your Health, Marathons, And All That.

Four Advantages Of Life Insurance. However, Our Primary Focus At I&e Is On Permanent Cash Value Life Insurance.

SELAMAT MEMBACA!

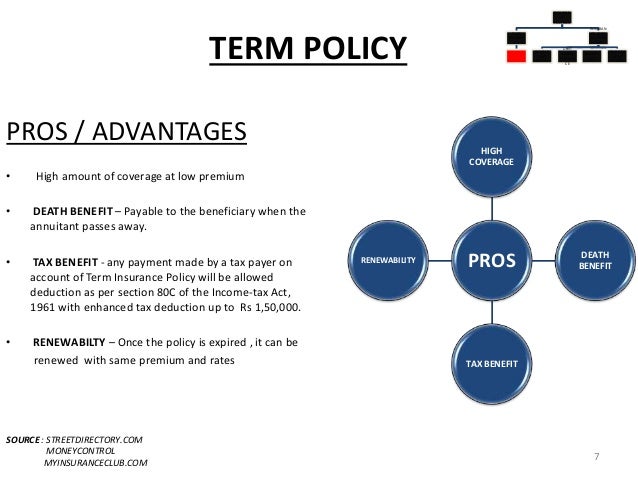

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

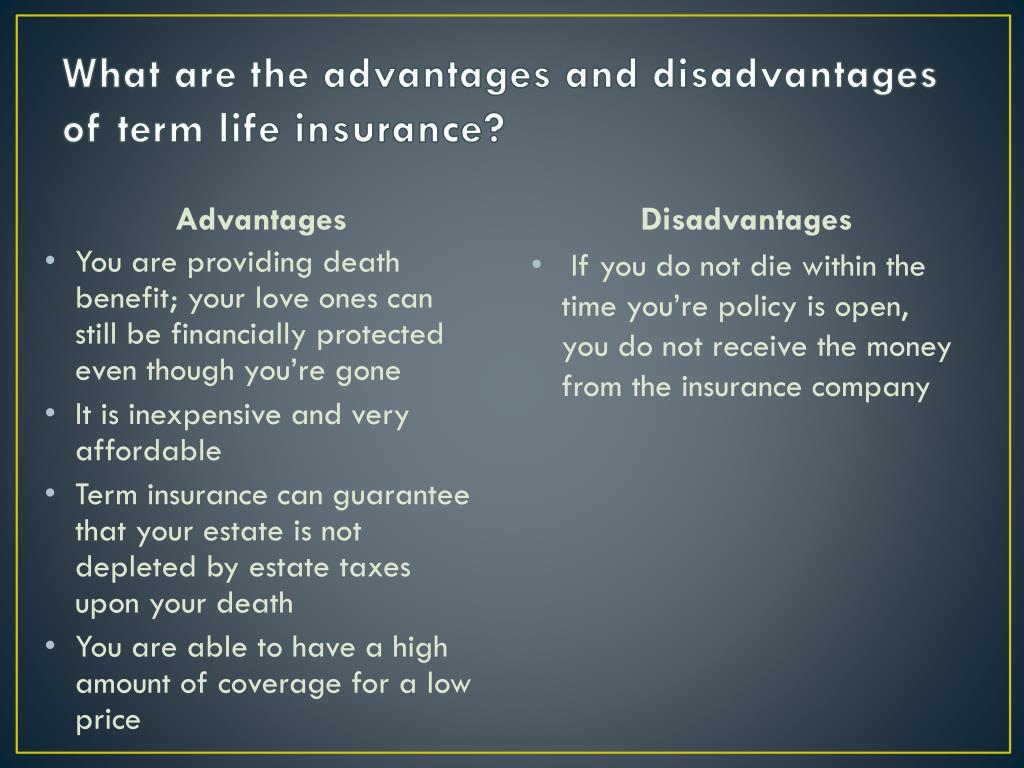

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Term life insurance offers four important advantages.

Term life insurance is easy to understand, which makes it simple to shop around and compare rates.

You need to make only three main decisions:

Term life insurance policies are still a great option with many advantages.

10 advantages of term life insurance.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

Forget your health, marathons, and all that.

Here are the basic questions:

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 there are four income cash value life insurance policies:

Participating whole life, current assumption universal life, indexed universal life and.

One of the biggest advantages of investing in life insurance is that you don't pay taxes on the money until you take it out.

If you keep paying premiums, you can keep the money in the account, accruing interest, until you die.

Advantages of term life insurance.

Here are some advantages and disadvantages of having life insurance and what you need to know before getting a life insurance policy.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

Whole life insurance is the most common form of permanent life insurance, which means that if you pay your premiums, you don't ever have to worry about your coverage expiring.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

Know the top 8 advantages of life insurance.

Investing in life insurance gives you and your family a secure future.

In case of any untoward happening to the insured, the insurer pays up the entire amount i.e.

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

![Term Life Insurance: Insider Tips [Research + Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/insproviders-live/9496f87a-term_life_insurance_advantages_disadvantages.png)

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

Hdfc life insurance company limited.

Let's look at the advantages and disadvantages of term life insurance.

Whether you buy whole life or term insurance, you will still need to be in great health to get the lowest rates.

There are advantages to specific policies that may not exist if you buy a different type of plan.

Permanent life insurance is not for everyone.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you.

Are there any types of life insurance policies that someone could pay the premium, and if for some reason they didn't use it, they would be able to get their money back?

What is a universal index life insurance?universal index life insurance policies are are permanent life insurance policies, build cash value over time, and.

Tax advantages of life insurance living benefits.

This is where it really gets good

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Life insurance provides advantages and disadvantages that are not available from any other financial instrument however it also has disadvantages.

Life insurance offers an infusion of cash that is intended for dealing with the adverse financial consequences of the insured's death.

Mengusir Komedo Membandel - Bagian 2Ternyata Tidur Terbaik Cukup 2 Menit!5 Khasiat Buah Tin, Sudah Teruji Klinis!!5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuTernyata Tidur Bisa Buat MeninggalSegala Penyakit, Rebusan Ciplukan ObatnyaTernyata Menikmati Alam Bebas Ada ManfaatnyaIni Efek Buruk Overdosis Minum KopiIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatPentingnya Makan Setelah OlahragaLife insurance offers an infusion of cash that is intended for dealing with the adverse financial consequences of the insured's death. Four Advantages Of Life Insurance. More and more life insurance companies are making the application process fast and easy.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

While life insurance is cheaper than most people think it is, you'll probably still have to open your wallet to pay your life insurance premiums.

Now that we've covered the more general advantages and disadvantages of life insurance, let's talk about how the policy you choose can shake things up.

As with most insurance products, the goal of a life insurance policy is to never need to use it.

Term life insurance policies are still a great option with many advantages.

Since a term life insurance policy is not just one product, but rather many variations on a general theme, different types of term insurance are required for different client needs.

Life insurance comes with great benefits and a few disadvantages.

But let's take some time to dive into what.

There are many life insurance benefits worth talking about.

However, our primary focus at i&e is on permanent cash value life insurance.

Meaning life insurance is the protection of a family against loss of income in case of the death of the person insured.

The policy is bought from an insurance company which will pay a fixed sum of money either at the there are many advantages and disadvantages of life insurance as discussed below.

Forget your health, marathons, and all that.

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

Lets insured adjust level of protection and cost of premiums.

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

Insurance provides economic and finanicial protection to the insured against the unexpected losses in consideration of nominal amount called premium.

Switching life insurance policies also doesn't generally introduce potential for additional taxation.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

In a term life insurance policy, the life insurance protection expires whenever the selected term renewing your term life insurance policy at that later stage in life would almost certainly cost while whole life premium payments in the early years are higher than those for term life, the advantages.

Advantages of term life insurance.

Initially less expensive premiums than whole life insurance advantages of whole life insurance.

You can build cash value or equity in a way that you can't with term life plans.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Term life insurance is the most basic form of life insurance.

Some of these reasons include.

For term life insurance, the advantages include having financial protection for your loved ones, while the disadvantages include having nothing to show for the premiums you've paid.

The pros and cons of living benefits life insurance include the biggest advantage, which is having cash you can borrow at.

Once a goal has been identified and a value for it has been crystallized, a life insurance policy is an.

Term life insurance has distinct advantages over other policies, but it comes with a few disadvantages as well.

Learn more in our guide.

Life insurance you can't be turned down for sounds too good to be true.

Guaranteed acceptance life insurance is one of the most expensive ways to buy life insurance.

Unless you have serious health conditions that would get you declined for other policies, look into other policy types first.

So here are our top four guaranteed issue life insurance companies.

Guaranteed issue policy should never be your first choice when buying.

Whole life insurance is a form of permanent life insurance that is designed to provide the owner with lifetime coverage.

What are the advantages of whole life insurance?

Advantages & disadvantages of whole life insurance policies.

Whole life insurance has some clear advantages over other.

Are there any types of life insurance policies that someone could pay the premium, and if for some reason they didn't use it, they would be able to get their money back?

The advantages of life insurance and how having life insurance is ensuring the financial security of your family, in case anything should happen to you suddenly.

The advantages of life insurance and how having life insurance is ensuring the financial security of your family, in case anything should happen to you suddenly. Four Advantages Of Life Insurance. You can save time and energy and also avoid unnecessary embarrassment of negating a life insurance advisor's quote by going online.Resep Kreasi Potato Wedges Anti GagalSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatResep Cumi Goreng Tepung MantulTernyata Bayam Adalah Sahabat WanitaKhao Neeo, Ketan Mangga Ala ThailandResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiResep Garlic Bread Ala CeritaKuliner Pete, Obat Alternatif DiabetesTernyata Asal Mula Soto Bukan Menggunakan Daging

Comments

Post a Comment