Four Advantages Of Life Insurance This Policy Allows The Family (spouse/children) To Be Left With Income Even In Cases Where The Second Policyholder's Death Results From The Death Of The Policyholder.

Four Advantages Of Life Insurance. Term Life Insurance Is The Most Basic Form Of Life Insurance.

SELAMAT MEMBACA!

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

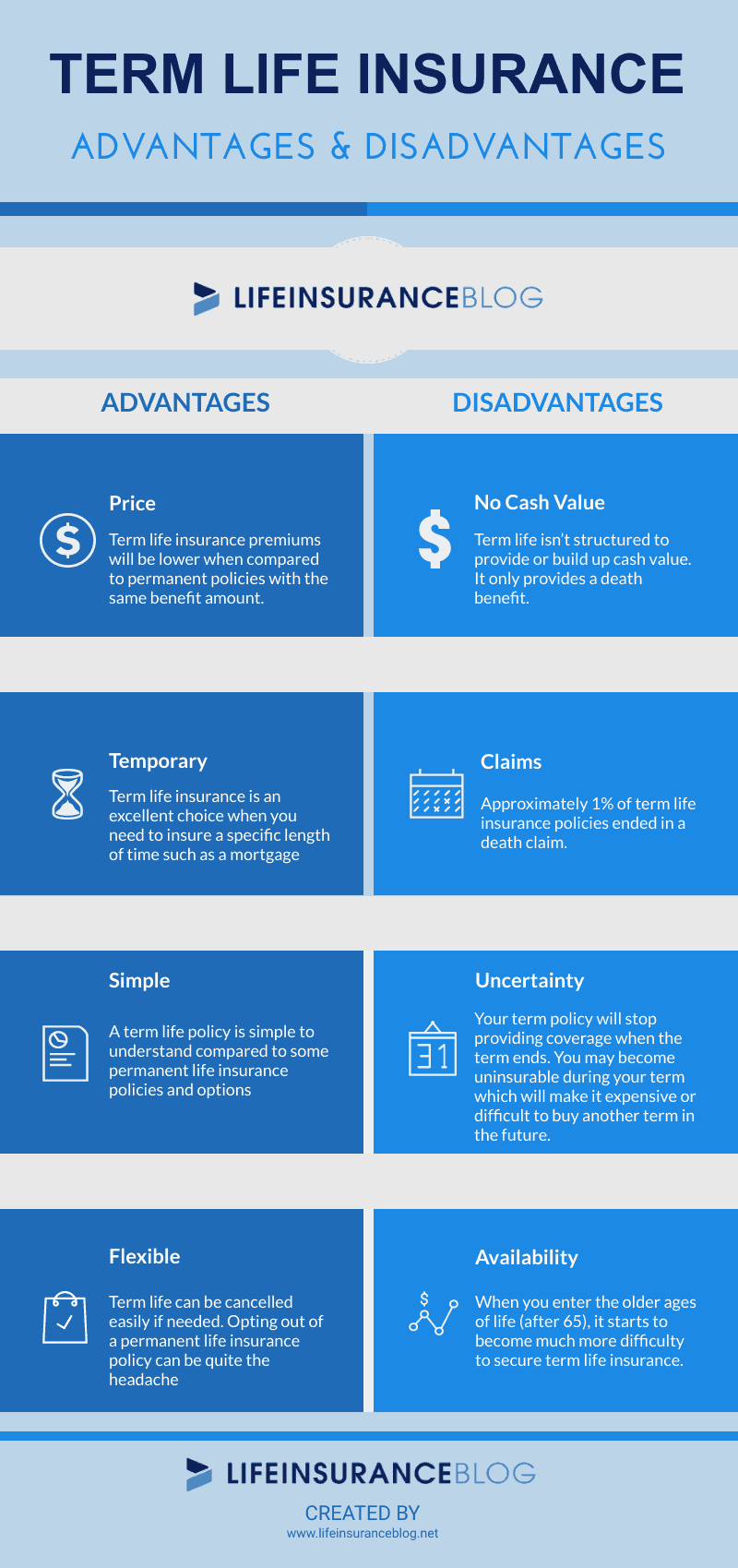

There are several advantages and disadvantages of life insurance.

Read on to know the benefits and drawbacks.

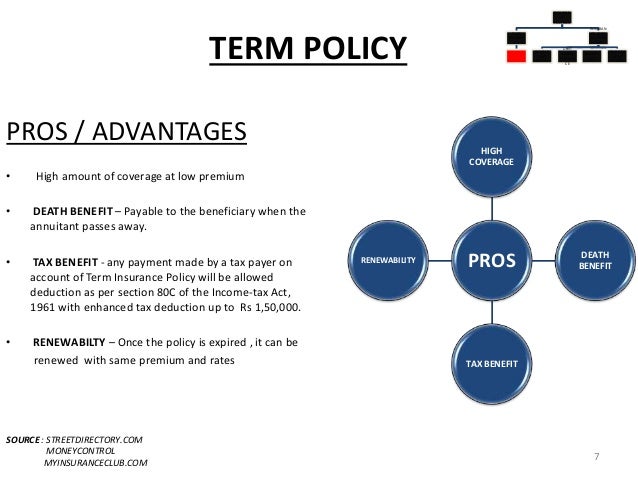

Term life insurance offers four important advantages.

Term life insurance is easy to understand, which makes it simple to shop around and compare rates.

Coverage amount, length of term and preferred company.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

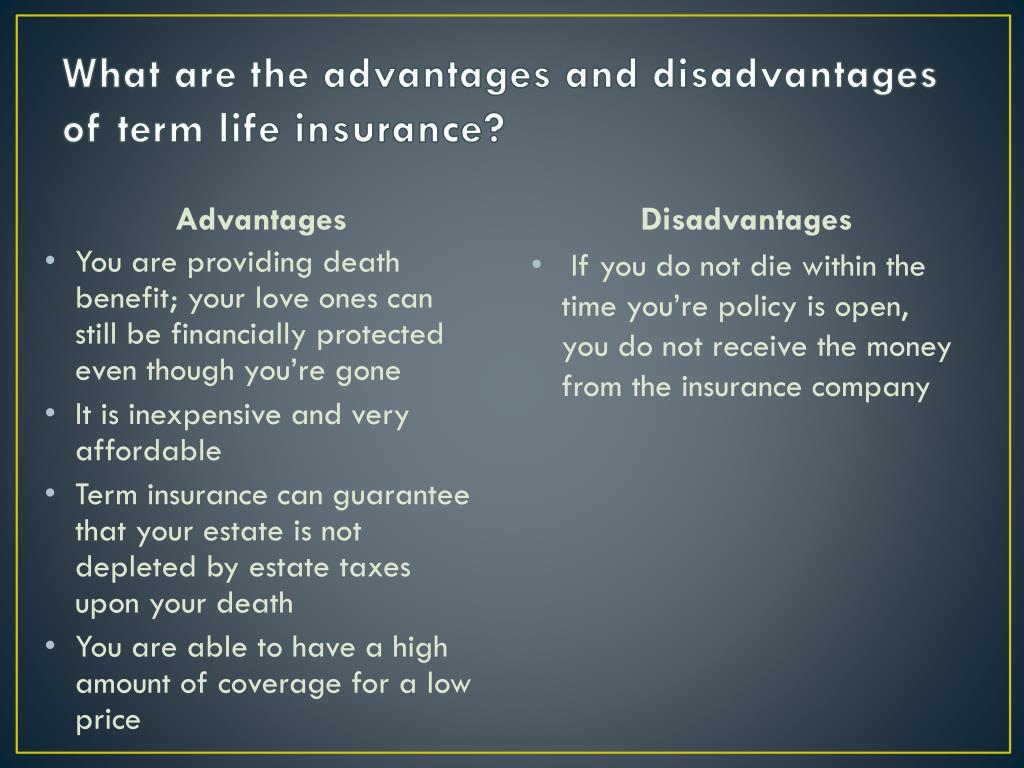

What are the advantages and disadvantages of term life insurance?

![Term Life Insurance: Insider Tips [Research + Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/insproviders-live/9496f87a-term_life_insurance_advantages_disadvantages.png)

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

Life insurance is generally of four types:

Life insurance is totally beneficial and serves as a financial support in those cases where the income of the family is stopped.

Life insurance as the name itself suggests is something that insures your life with a financial support.

There are many life insurance benefits worth talking about.

However, our primary focus at i&e is on permanent cash value life insurance.

Term life insurance policies are still a great option with many advantages.

10 advantages of term life insurance.

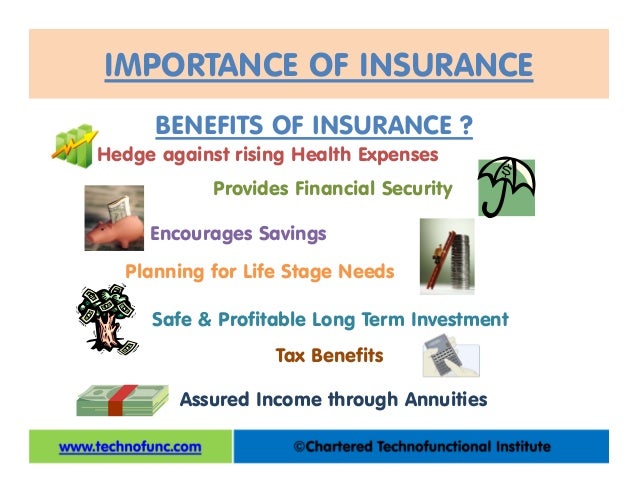

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

In a cost efficient manner.

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 there are four income cash value life insurance policies:

List of the advantages of life insurance.

Life insurance pays a benefit when you might need it the most.

The primary advantage to consider with a life insurance policy is the benefit that it pays to your surviving family members or designated heir.

Here are the basic questions:

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

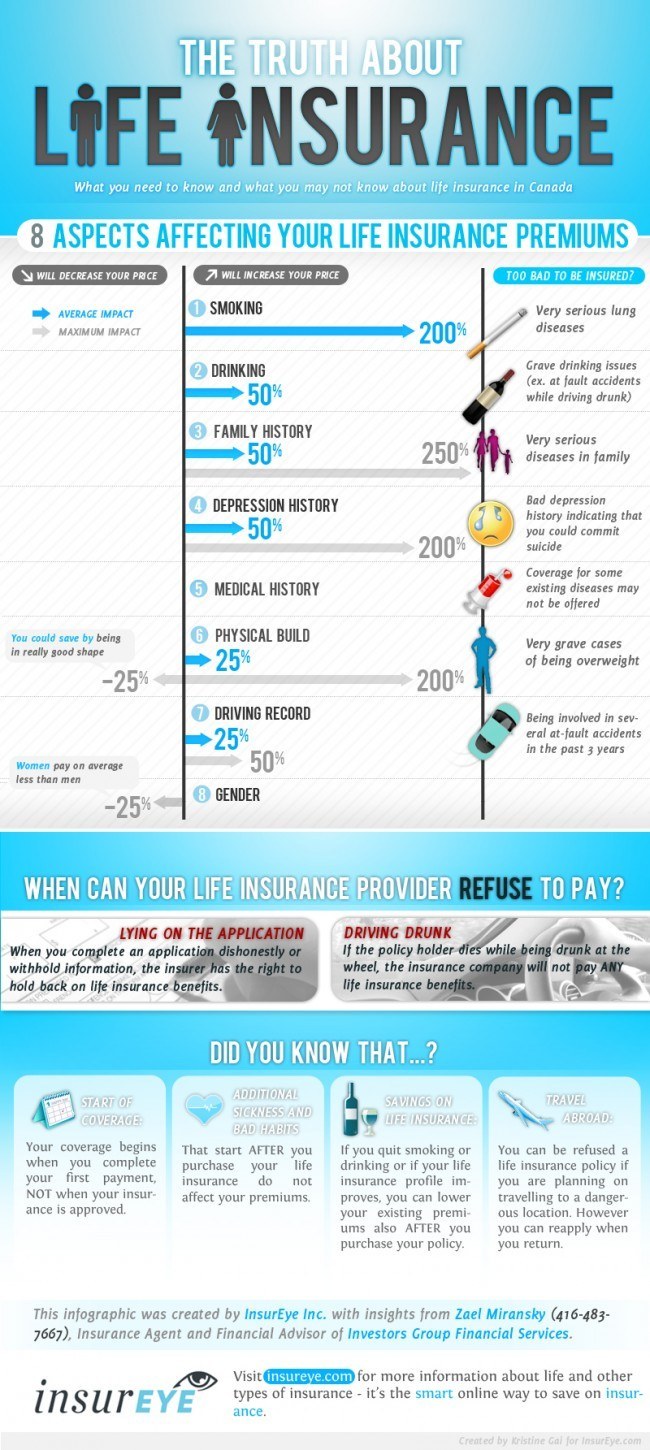

One of the biggest advantages of investing in life insurance is that you don't pay taxes on the money until you take it out.

If you keep paying premiums, you can keep the money in the account, accruing interest, until you die.

Here are some advantages and disadvantages of having life insurance and what you need to know before getting a life insurance policy.

Life insurance has various advantages that can guarantee your own financial security and that of your family as well.

Let us tell you how your life your life insurance can ensure your family has a comfortable lifestyle if you are not around to support them.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

Whole life insurance is the most common form of permanent life insurance, which means that if you pay your premiums, you don't ever have to worry about your coverage expiring.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

Know the top 8 advantages of life insurance.

Investing in life insurance gives you and your family a secure future.

In case of any untoward happening to the insured, the insurer pays up the entire amount i.e.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

Term life insurance and whole life insurance offer this benefit, although term insurance places a limit on how long the coverage will remain in force.

A risk life insurance policy is the most basic life insurance policy you can purchase.

This policy allows the family (spouse/children) to be left with income even in cases where the second policyholder's death results from the death of the policyholder.

If the policyholder does not explicitly determine who is the.

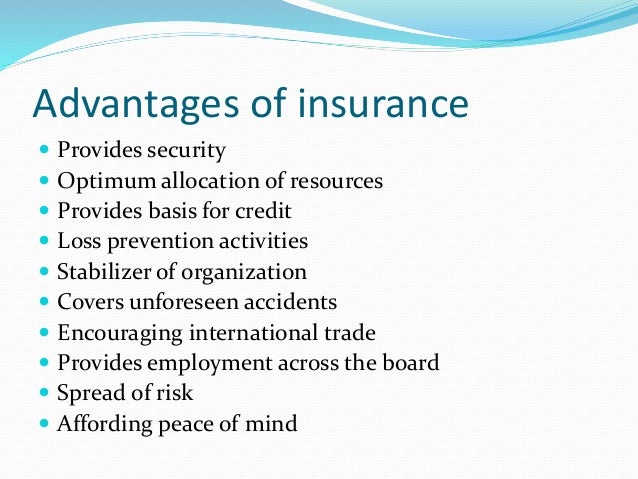

Insurance provides economic and finanicial protection to the insured against the unexpected losses in consideration of nominal amount called premium.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you.

Are there any types of life insurance policies that someone could pay the premium, and if for some reason they didn't use it, they would be able to get their money back?

Term life insurance is probably the most popular form of protection because of its lowest cost.

Whether you buy whole life or term insurance, you will still need to be in great health to get the lowest rates.

In the past few years life insurance policies have been adopted by various people and many people has taken advantages of these policies as well after the death of the family members.

Suppose you were a 75 year old woman and bought a $500,000 lifetime guaranteed policy advantages of an ilit.

Ilit trusts are especially advantageous for several reasons.

Ternyata Tahan Kentut Bikin KeracunanCara Baca Tanggal Kadaluarsa Produk MakananJam Piket Organ Tubuh (Hati) Bagian 2Cegah Celaka, Waspada Bahaya Sindrom HipersomniaSehat Sekejap Dengan Es BatuTernyata Ini Beda Basil Dan Kemangi!!4 Titik Akupresur Agar Tidurmu NyenyakMelawan Pikun Dengan ApelVitalitas Pria, Cukup Bawang Putih SajaHindari Makanan Dan Minuman Ini Kala Perut KosongThe first is for those who have particularly large estates. Four Advantages Of Life Insurance. A family of life insurance policies designed to help meet a lifetime of needs.

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

There are many life insurance benefits worth talking about.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

10 advantages of term life insurance.

Life insurance has many advantages, but there can be disadvantages if you choose the wrong policy, don't do your homework, or skip shopping around.

List of the advantages of life insurance.

A policy surrender with life insurance takes years to recoup the value.

One of the advantages of whole life insurance is that you have a cash surrender value available.

This is strikingly character demand because of its bent to provide cash protection and accrue capital value again pay dividends to the insured.

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

Let us tell you how your life insurance 1,50,000 on life insurance under section 80c.

With various types of life insurance plans available, you can plan your.

Advantages of life insurance investing.

If you keep paying premiums, you can keep the money in the account, accruing interest, until you die.

Understand the need & advantages of life insurance & how it plays the dual role of savings & security in human life.

Hdfc life insurance company limited.

Here are the basic questions:

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or key man life insurance is highly recommended to help the company survive the hardship of losing a key employee.

The life insurance proceeds will be used by.

This life protection won't vanish if premiums are paid — it's a financial product that remains in place for your entire life.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Life insurance provides you the advantage of taking a policy loan in case you are in desperate need of money.

The loan amount that can be taken in a percentage of the cash value or sum assured under policy depending on the policy provisions.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Permanent life insurance is not for everyone.

If you want to buy coverage for the traditional use, then the cost of permanent insurance may be much too.

Permanent life insurance is also called cash value insurance.

The major advantages of buying a permanent life insurance policy are the death benefit, cash value growth, and you lock in the premium.

What is a universal index life insurance?universal index life insurance policies are are permanent life insurance policies, build cash value over time, and.

Let's look at the advantages and disadvantages of term life insurance.

You may continue with your current policy without taking an exam or proving insurability;

However, it will be significantly more expensive, and the rate will increase every.

Other than these advantages a life insurance policy also helps a person in paying taxes.

After the death of a person who is insured, his family members receive the amount of money without taxes imposed on them.

There are so many debts that the typical american can amass that it requires its own general category it is true that buying life insurance takes some pressure off of your shoulders and allows you to sleep at night.

By shifting the risk of an untimely.

When you meet with a client regarding life insurance, how long does it take to do a plan, or a review with them to determine how much coverage they need and to come up.

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

The life insurance policy gives full financial support to the insured in his old age.

Generally, life insurance premiums are not tax deductible.

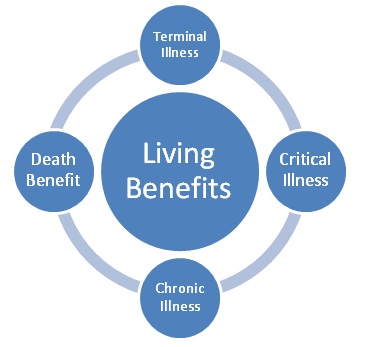

Tax advantages of life insurance living benefits.

This is where it really gets good

You'll run into a lot of terms that you may not understand at first.

The good news is those terms are not very difficult to figure out once you do a little research.

The good news is those terms are not very difficult to figure out once you do a little research. Four Advantages Of Life Insurance. These tips are designed to help you [.]Sensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanTernyata Pecel Pertama Kali Di Makan Oleh Sunan KalijagaResep Ayam Suwir Pedas Ala CeritaKulinerBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi LuwakSejarah Gudeg JogyakartaResep Racik Bumbu Marinasi IkanIkan Tongkol Bikin Gatal? Ini PenjelasannyaKuliner Jangkrik Viral Di JepangSusu Penyebab Jerawat???Resep Selai Nanas Homemade

Comments

Post a Comment