Identify 4 Advantages Of Life Insurance Unless You Have Serious Health Conditions That Would Get You Declined For Other Policies, Look Into Other Policy Types First.

Identify 4 Advantages Of Life Insurance. If You Have Loved Ones Who Depend Upon You Financially, You Need Life Insurance.

SELAMAT MEMBACA!

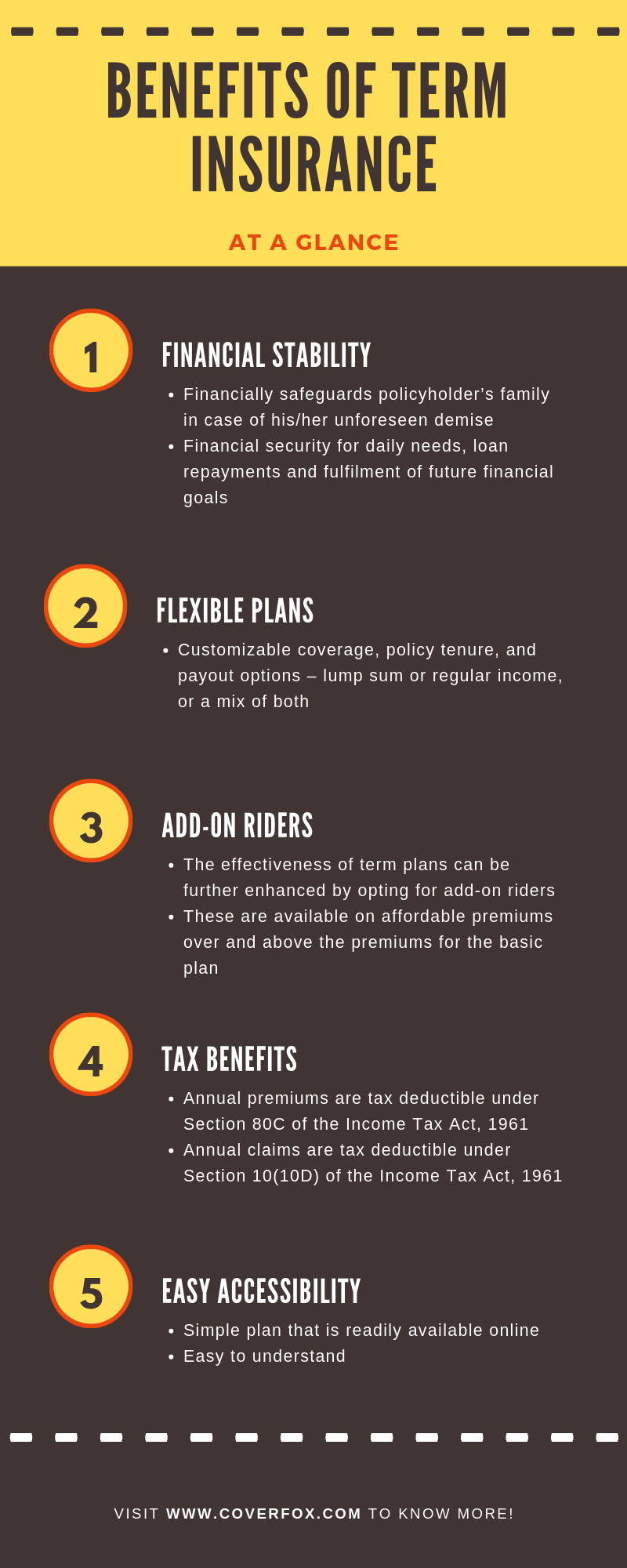

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

While life insurance is cheaper than most people think it is, you'll probably still have to open your wallet to pay your life insurance premiums.

Now that we've covered the more general advantages and disadvantages of life insurance, let's talk about how the policy you choose can shake things up.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Read on to know the benefits and drawbacks.

For me life insurance is like a gate of empire and acts as a first line of defense in protecting myself and safeguard my family.

Life insurance is generally of four types:

Understand the need & advantages of life insurance & how it plays the dual role of advantages of life insurance.

Once a goal has been identified and a value for it has been crystallized, a life insurance policy is an.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Term life insurance policies are still a great option with many advantages.

As with most insurance products, the goal of a life insurance policy is to never need to use it.

This coverage offers financial protection to your loved ones several different forms of life insurance are available in today's market to help you meet the specific needs of your family.

Some advantages of life insurance are:

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

Meaning life insurance is the protection of a family against loss of income in case of the death of the person insured.

The policy is bought from an insurance company which will pay a fixed sum of money either at the there are many advantages and disadvantages of life insurance as discussed below.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or first and foremost, your life insurance application will get approved and secondly, your premium will be much lower.

Depending on your age and the amount of.

With life insurance, the insured person can benefit from periodic bonuses that are.

Term life insurance has distinct advantages over other policies, but it comes with a few disadvantages as well.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

While whole life premium payments in the early years are higher than those for term life, the advantages increase significantly as time passes.

For term life insurance, the advantages include having financial protection for your loved ones, while the disadvantages include having nothing to show for the premiums you've paid.

The pros and cons of living benefits life insurance include the biggest advantage, which is having cash you can borrow at.

However, it has a couple of distinct differences of which you should be aware.

Burial insurance is much cheaper than a large life insurance plan, but there are several other advantages to it.

The first is that anyone can purchase.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

Life insurance benefits from favorable tax treatment unlike any other financial instrument.

Start studying chapter 4 life insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

A good life insurance policy provides you and your family with financial security and protection unavailable from any other source.

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

Insurance provides economic and finanicial protection to the insured against the unexpected losses in consideration of nominal amount called premium.

Guaranteed acceptance life insurance is one of the most expensive ways to buy life insurance.

Unless you have serious health conditions that would get you declined for other policies, look into other policy types first.

Life insurance is part of estate planning.

Depending on the size of the benefit you want to provide and the amount you can afford to pay on premiums, you can choose from several different types of life insurance policies.

Aig life insurance company is one of the biggest life insurance companies in the world, with more than 88 million policyholders in 130 countries.

Uban, Lawan Dengan Kulit KentangTak Hanya Manis, Ini 5 Manfaat Buah SawoManfaat Kunyah Makanan 33 KaliIni Manfaat Seledri Bagi KesehatanResep Alami Lawan Demam Anak5 Tips Mudah Mengurangi Gula Dalam Konsumsi Sehari-HariIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab Jerawat4 Manfaat Minum Jus Tomat Sebelum TidurTernyata Tidur Bisa Buat KankerGawat! Minum Air Dingin Picu Kanker!So here are our top four guaranteed issue life insurance companies. Identify 4 Advantages Of Life Insurance. Guaranteed issue policy should never be your first choice when buying.

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

While life insurance is cheaper than most people think it is, you'll probably still have to open your wallet to pay your life insurance premiums.

Now that we've covered the more general advantages and disadvantages of life insurance, let's talk about how the policy you choose can shake things up.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

Read on to know the benefits and drawbacks.

For me life insurance is like a gate of empire and acts as a first line of defense in protecting myself and safeguard my family.

Life insurance is generally of four types:

Understand the need & advantages of life insurance & how it plays the dual role of advantages of life insurance.

Once a goal has been identified and a value for it has been crystallized, a life insurance policy is an.

However, our primary focus at i&e is on permanent cash value life insurance.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Term life insurance policies are still a great option with many advantages.

As with most insurance products, the goal of a life insurance policy is to never need to use it.

This coverage offers financial protection to your loved ones several different forms of life insurance are available in today's market to help you meet the specific needs of your family.

Some advantages of life insurance are:

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

Meaning life insurance is the protection of a family against loss of income in case of the death of the person insured.

The policy is bought from an insurance company which will pay a fixed sum of money either at the there are many advantages and disadvantages of life insurance as discussed below.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or first and foremost, your life insurance application will get approved and secondly, your premium will be much lower.

Depending on your age and the amount of.

With life insurance, the insured person can benefit from periodic bonuses that are.

Term life insurance has distinct advantages over other policies, but it comes with a few disadvantages as well.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

While whole life premium payments in the early years are higher than those for term life, the advantages increase significantly as time passes.

For term life insurance, the advantages include having financial protection for your loved ones, while the disadvantages include having nothing to show for the premiums you've paid.

The pros and cons of living benefits life insurance include the biggest advantage, which is having cash you can borrow at.

However, it has a couple of distinct differences of which you should be aware.

Burial insurance is much cheaper than a large life insurance plan, but there are several other advantages to it.

The first is that anyone can purchase.

Term life insurance is the most basic form of life insurance.

It is designed to provide affordable death protection for the short term and pays a benefit only if if you are shopping for life insurance, there are compelling reasons why you should consider term life insurance.

Some of these reasons include.

Life insurance benefits from favorable tax treatment unlike any other financial instrument.

Start studying chapter 4 life insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

A good life insurance policy provides you and your family with financial security and protection unavailable from any other source.

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

Insurance provides economic and finanicial protection to the insured against the unexpected losses in consideration of nominal amount called premium.

Guaranteed acceptance life insurance is one of the most expensive ways to buy life insurance.

Unless you have serious health conditions that would get you declined for other policies, look into other policy types first.

Life insurance is part of estate planning.

Depending on the size of the benefit you want to provide and the amount you can afford to pay on premiums, you can choose from several different types of life insurance policies.

Aig life insurance company is one of the biggest life insurance companies in the world, with more than 88 million policyholders in 130 countries.

So here are our top four guaranteed issue life insurance companies. Identify 4 Advantages Of Life Insurance. Guaranteed issue policy should never be your first choice when buying.Trik Menghilangkan Duri Ikan BandengWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Tips Memilih Beras BerkualitasTernyata Inilah Makanan Paling Buat Salah PahamResep Beef Teriyaki Ala CeritaKuliner7 Langkah Mudah Cara Buat Pizza Mini Tanpa Oven Untuk JualanResep Ponzu, Cocolan Ala JepangPecel Pitik, Kuliner Sakral Suku Using BanyuwangiResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangAyam Goreng Kalasan Favorit Bung Karno

Comments

Post a Comment