Identify 4 Advantages Of Life Insurance Whether It Is A Nonliving Product Like A Car Or It About Our Own Health, We Don't Want.

Identify 4 Advantages Of Life Insurance. Whole Life Insurance Has Some Clear Advantages Over Other.

SELAMAT MEMBACA!

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

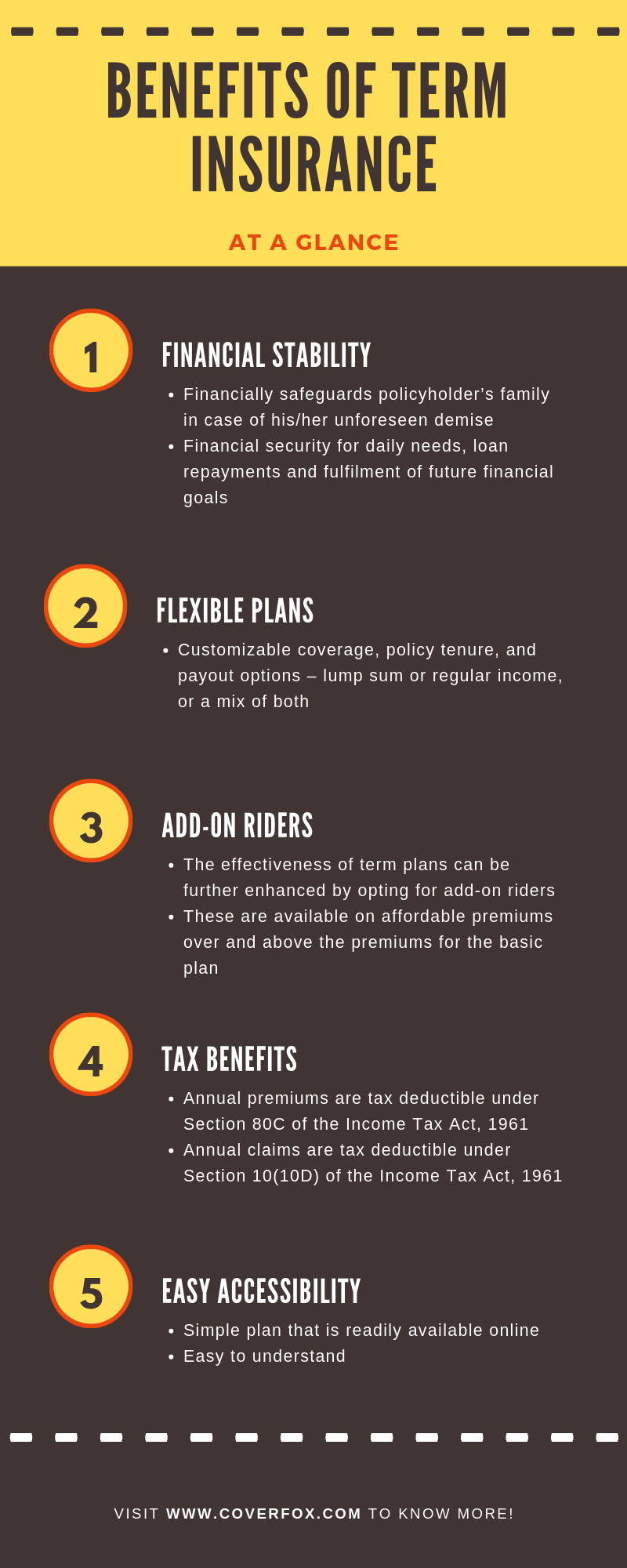

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

While life insurance is cheaper than most people think it is, you'll probably still have to open your wallet to pay your life insurance premiums.

Now that we've covered the more general advantages and disadvantages of life insurance, let's talk about how the policy you choose can shake things up.

Term life insurance policies are still a great option with many advantages.

As with most insurance products, the goal of a life insurance policy is to never need to use it.

This coverage offers financial protection to your loved ones several different forms of life insurance are available in today's market to help you meet the specific needs of your family.

There are many life insurance benefits worth talking about.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Life insurance comes with great benefits and a few disadvantages.

For the average person out there looking to gain a better understanding of life it's little surprise that we identify death benefit as a top advantage to life insurance.it seems almost too obvious.

Meaning life insurance is the protection of a family against loss of income in case of the death of the person insured.

The policy is bought from an insurance company which will pay a fixed sum of money either at the there are many advantages and disadvantages of life insurance as discussed below.

Forget your health, marathons, and all that.

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

Lets insured adjust level of protection and cost of premiums.

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

Term life insurance has distinct advantages over other policies, but it comes with a few disadvantages as well.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Once a goal has been identified and a value for it has been crystallized, a life insurance policy is an.

For term life insurance, the advantages include having financial protection for your loved ones, while the disadvantages include having nothing to show for the premiums you've paid.

The pros and cons of living benefits life insurance include the biggest advantage, which is having cash you can borrow at.

While whole life premium payments in the early years are higher than those for term life, the advantages increase significantly as time passes.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or first and foremost, your life insurance application will get approved and secondly, your premium will be much lower.

Depending on your age and the amount of.

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

Insurance provides economic and finanicial protection to the insured against the unexpected losses in consideration of nominal amount called premium.

Term life insurance is the most basic form of life insurance.

Some of these reasons include.

Life insurance you can't be turned down for sounds too good to be true.

Guaranteed acceptance life insurance is one of the most expensive ways to buy life insurance.

Aig life insurance company is one of the biggest life insurance companies in the world, with more than 88 million policyholders in 130 countries.

So here are our top four guaranteed issue life insurance companies.

Guaranteed issue policy should never be your first choice when buying.

Whole life insurance has some clear advantages over other.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you.

Are there any types of life insurance policies that someone could pay the premium, and if for some reason they didn't use it, they would be able to get their money back?

You can save time and energy and also avoid unnecessary embarrassment of negating a life insurance advisor's quote by going online.

Another advantage of using an independent insurance agent is that you will be able to save money.

When you look at different choices, you can generally find one that is quite a bit cheaper than the rest.

An insurance company, which sells the insurance to insured or policyholder, is called as insurer.

Insurance is one of the instruments for retirement planning.

Money saved at the time of earning life and that money will be utilized after retirement.

For more information about life insurance plans visit aegonreligare.com.

The main advantage of whole life insurance is that it will guarantee (for most policies) that your life insurance will never end.

Uban, Lawan Dengan Kulit KentangCegah Celaka, Waspada Bahaya Sindrom HipersomniaHindari Makanan Dan Minuman Ini Kala Perut Kosong5 Manfaat Posisi Viparita Karani10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 1)Ternyata Ini Beda Basil Dan Kemangi!!Ternyata Cewek Curhat Artinya SayangFakta Salah Kafein KopiPentingnya Makan Setelah OlahragaTernyata Tertawa Itu DukaThe main advantage of whole life insurance is that it will guarantee (for most policies) that your life insurance will never end. Identify 4 Advantages Of Life Insurance. Whole life also offers cash value.

4 advantages of life insurance.

As people can't see their future they try to protect with some insurance policy.

Whether it is a nonliving product like a car or it about our own health, we don't want.

Term life insurance offers four important advantages.

You need to make only three main decisions:

Coverage amount, length of term and preferred company.

What are the advantages and disadvantages of term life insurance?

When you own a life insurance policy and you pass away, the beneficiaries that are named on your term policy will get.

There are several advantages and disadvantages of life insurance.

A lot of people invest in a life insurance policy, but not many people understand the pros and cons.

While life insurance is cheaper than most people think it is, you'll probably still have to open your wallet to pay your life insurance premiums.

Now that we've covered the more general advantages and disadvantages of life insurance, let's talk about how the policy you choose can shake things up.

Term life insurance policies are still a great option with many advantages.

![[BREAKING NEWS] Advantages And Disadvantages Of Using ...](https://image.slidesharecdn.com/71ea9144-a645-4138-afb4-45a6bec265c9-150212202140-conversion-gate01/95/bus-learning-series-linkedin-instagram-10-638.jpg?cb=1423772686)

As with most insurance products, the goal of a life insurance policy is to never need to use it.

This coverage offers financial protection to your loved ones several different forms of life insurance are available in today's market to help you meet the specific needs of your family.

There are many life insurance benefits worth talking about.

So, the majority of the article on the advantages and disadvantages of life insurance will be focused there.

Life insurance comes with great benefits and a few disadvantages.

For the average person out there looking to gain a better understanding of life it's little surprise that we identify death benefit as a top advantage to life insurance.it seems almost too obvious.

Meaning life insurance is the protection of a family against loss of income in case of the death of the person insured.

The policy is bought from an insurance company which will pay a fixed sum of money either at the there are many advantages and disadvantages of life insurance as discussed below.

Forget your health, marathons, and all that.

Do you give a crap about whatever financial burden your survivors would undertake when you kick the bucket?

If no, you don't care, then forget life insurance;

Lets insured adjust level of protection and cost of premiums.

Some advantages of life insurance are:

Being able to leave money to provide for those who would be financially hurt by the insured person's death, 2 2.

Getting life insurance when what the clients really want is a potentially high paying investment, and they are ok with risk.

Those who are concerned that their life insurance policies no longer provide the benefits needed or that their premiums no longer suit their needs are able to adjust them easily.

Term life insurance has distinct advantages over other policies, but it comes with a few disadvantages as well.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Once a goal has been identified and a value for it has been crystallized, a life insurance policy is an.

For term life insurance, the advantages include having financial protection for your loved ones, while the disadvantages include having nothing to show for the premiums you've paid.

The pros and cons of living benefits life insurance include the biggest advantage, which is having cash you can borrow at.

While whole life premium payments in the early years are higher than those for term life, the advantages increase significantly as time passes.

#2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or first and foremost, your life insurance application will get approved and secondly, your premium will be much lower.

Depending on your age and the amount of.

Advantages of insurance insurance provides benefits to an individual, family, businessman as well as a society.

Insurance provides economic and finanicial protection to the insured against the unexpected losses in consideration of nominal amount called premium.

Term life insurance is the most basic form of life insurance.

Some of these reasons include.

Life insurance you can't be turned down for sounds too good to be true.

Guaranteed acceptance life insurance is one of the most expensive ways to buy life insurance.

Aig life insurance company is one of the biggest life insurance companies in the world, with more than 88 million policyholders in 130 countries.

So here are our top four guaranteed issue life insurance companies.

Guaranteed issue policy should never be your first choice when buying.

Whole life insurance has some clear advantages over other.

Life insurance has advantages and life insurance can help protect your family, if your income is lost if something happens to you.

Are there any types of life insurance policies that someone could pay the premium, and if for some reason they didn't use it, they would be able to get their money back?

You can save time and energy and also avoid unnecessary embarrassment of negating a life insurance advisor's quote by going online.

Another advantage of using an independent insurance agent is that you will be able to save money.

When you look at different choices, you can generally find one that is quite a bit cheaper than the rest.

An insurance company, which sells the insurance to insured or policyholder, is called as insurer.

Insurance is one of the instruments for retirement planning.

Money saved at the time of earning life and that money will be utilized after retirement.

For more information about life insurance plans visit aegonreligare.com.

The main advantage of whole life insurance is that it will guarantee (for most policies) that your life insurance will never end.

The main advantage of whole life insurance is that it will guarantee (for most policies) that your life insurance will never end. Identify 4 Advantages Of Life Insurance. Whole life also offers cash value.5 Cara Tepat Simpan TelurResep Stawberry Cheese Thumbprint CookiesAmit-Amit, Kecelakaan Di Dapur Jangan Sampai Terjadi!!Resep Cream Horn PastryNikmat Kulit Ayam, Bikin SengsaraKuliner Jangkrik Viral Di JepangBakwan Jamur Tiram Gurih Dan NikmatResep Yakitori, Sate Ayam Ala JepangIni Beda Asinan Betawi & Asinan BogorSusu Penyebab Jerawat???

Comments

Post a Comment